Reporting 1099C Income If you get a 1099C for a personal debt, you must enter the total on Line 21 of Form 1040 personal income tax If it's a business or farm debt, use a Schedule C or Schedule F, profit and loss from business or farming Include as income any interest you would have been eligible to deductForm 1099C 21 Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRS determinesTo associate the 1099MISC or a 1099NEC to a Schedule C, perform the following steps in the program After entering the information, click Continue to save and be taken to the next page You will then be asked where you want to add the income You can Create a new Schedule C or add the income to an existing Schedule C (same type of work)

Tax Documents That Every Freelancer And Contractor Needs Form Pros

1099 nec form 2020 schedule c

1099 nec form 2020 schedule c-19 Schedule C Form Fill out, securely sign, print or email your 19 Instructions for Forms 1099A and 1099C IRSgov instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!Select Jump to schedule C

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

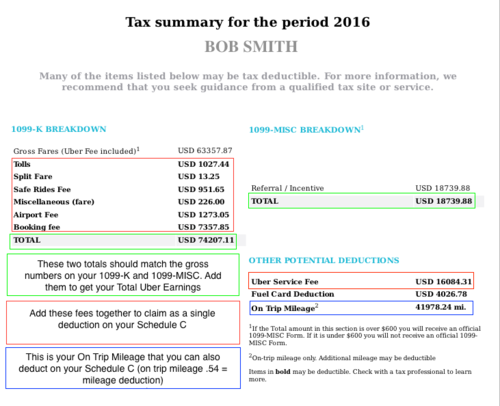

1099NEC Snap and Autofill Available in TurboTax SelfEmployed and TurboTax Live SelfEmployed starting Available in mobile app only Feature available within Schedule C tax form for TurboTax filers with 1099NEC income Starting with the tax year , the 1099MISC has been redesigned because of the creation of Form 1099NEC Organizations will no longer report nonemployee compensation, like payments to independent contractors, on Form 1099MISC To know more about the Form 1099MISC and Form 1099NEC, attend the Compliance Prime webinar viewsTo report your 1099K income on this form, simply enter your gross 1099K income on line 1a of Schedule C Your 1099K income is separate from your earnings received by cash, check, or any other means List the total income received by these methods on line 1b To calculate your gross receipts for the year, add the amount from line 1a with the

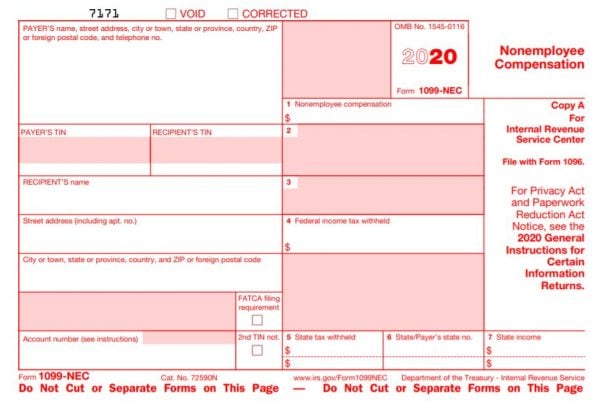

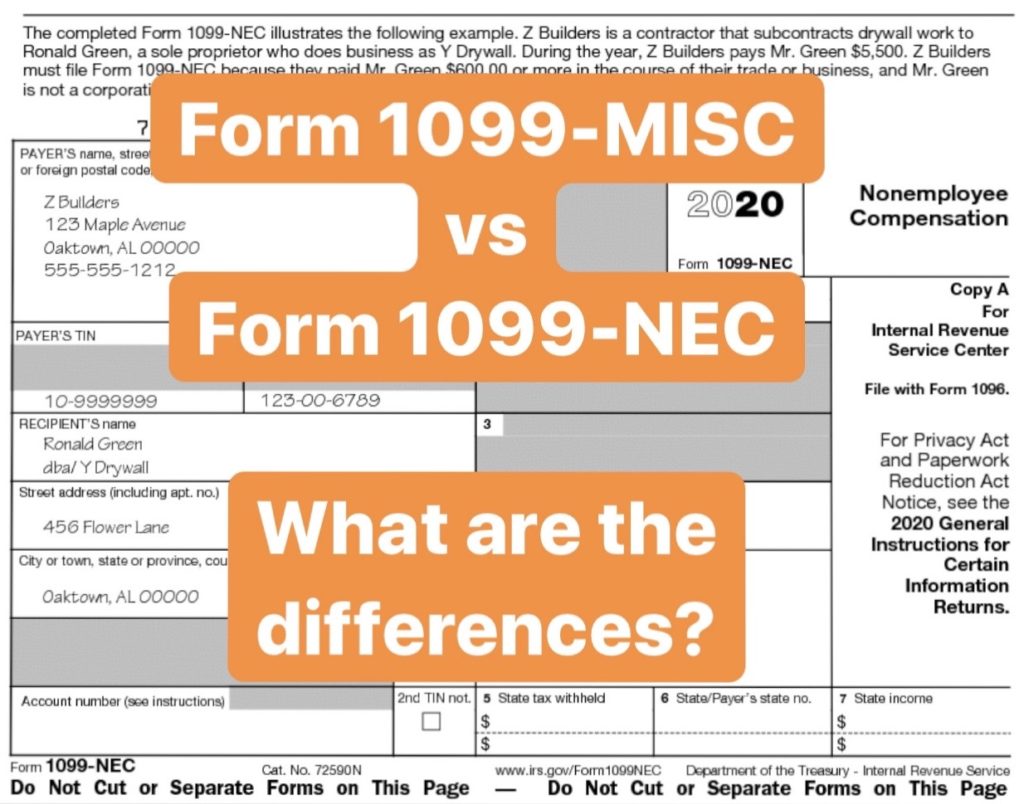

If yes, and you paid them more than $600 in , you'll also need to send Form 1099NEC to those whom you pay $600 or more (before , you would have reported those payments on Form 1099MISC) Okay, great job so far!Form 1099MISC IRS tax forms payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax If your net products on Schedule C (Form 1040 or 1040SR)The Form 1099NEC is new for and is used to report payments to nonemployees for services The Form 1099MISC was used to report nonemployment compensation until , but it is now used to report most other types of payments to a nonemployee

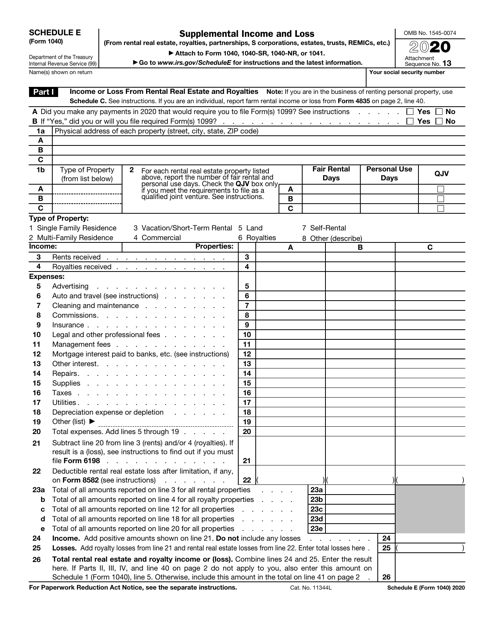

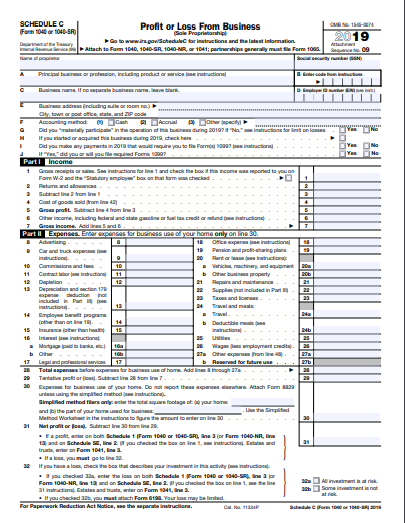

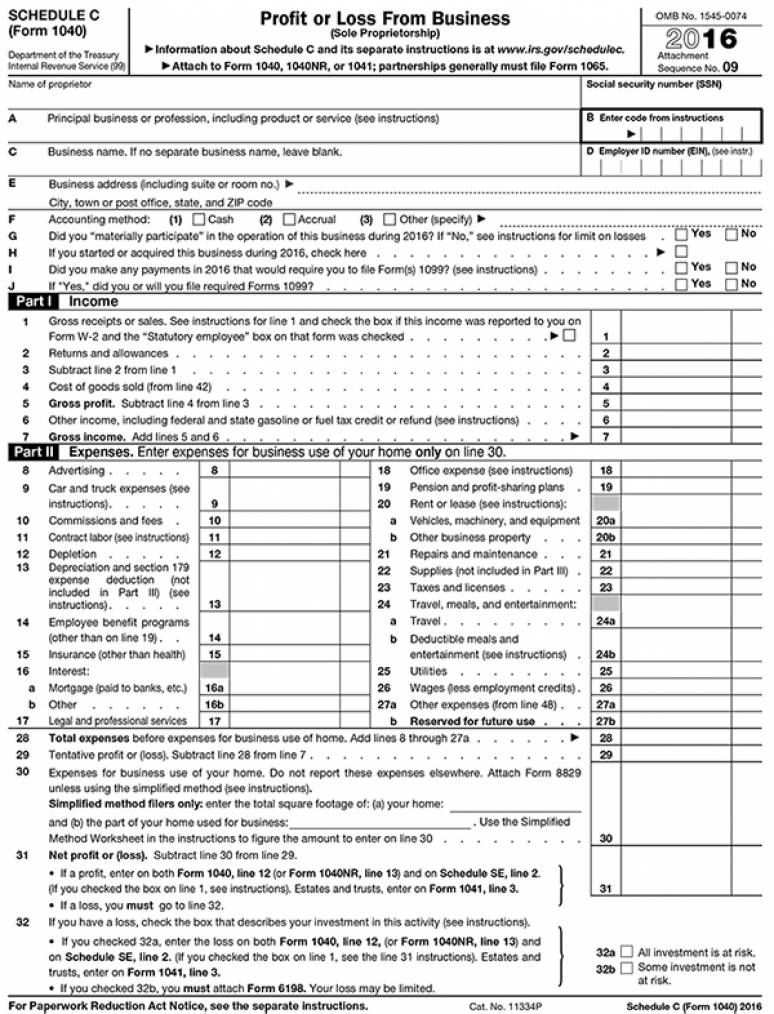

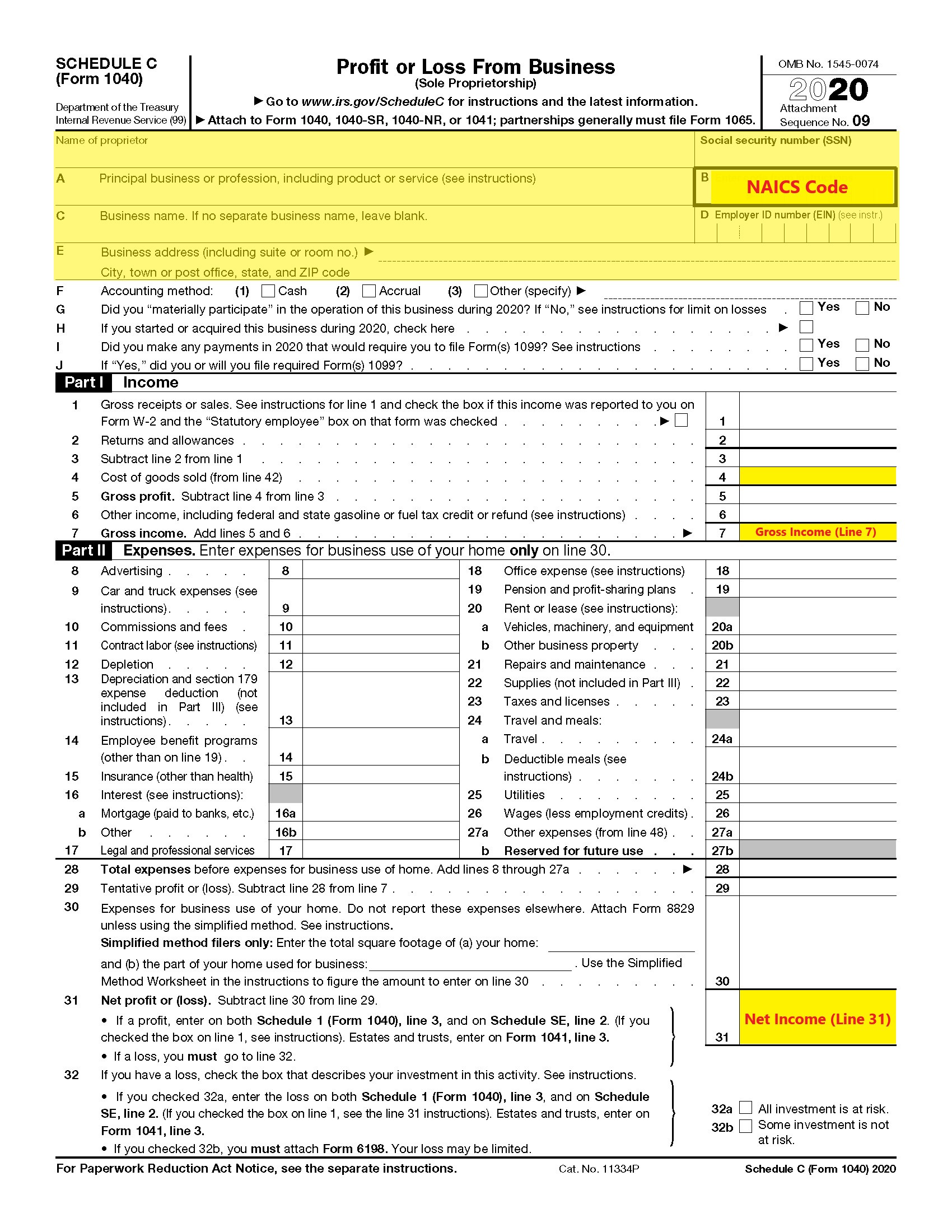

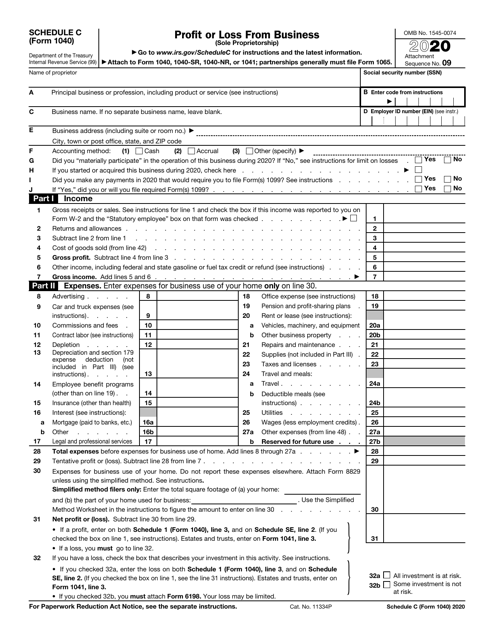

Schedule C, whose full name is Form 1040 Schedule C Before , you'd file Form 1099MISC Starting in , you file Form 1099NEC for each independent contractor to whom you paid $600 or 1099MISC Schedule C If you receive income for nonemployee compensation, you must include it in income If you work in any capacity and did not receive a Form W2 for wages, you must complete Schedule C To enter the income from a Box 7, 1099Misc You can enter a 1099MISC on the 1099MISC Summary screenTo enter or review the information for Form 1099MISC Miscellaneous Income, Box 1 Rents If you have not already entered the applicable Schedule E (Form 1040) Supplemental Income and Loss information From within your TaxAct return (Online or Desktop), click FederalOn smaller devices, click in the upper lefthand corner, then click Federal;

Walk Through Filing Taxes As An Independent Contractor

What Is Form 1099 Nec For Nonemployee Compensation

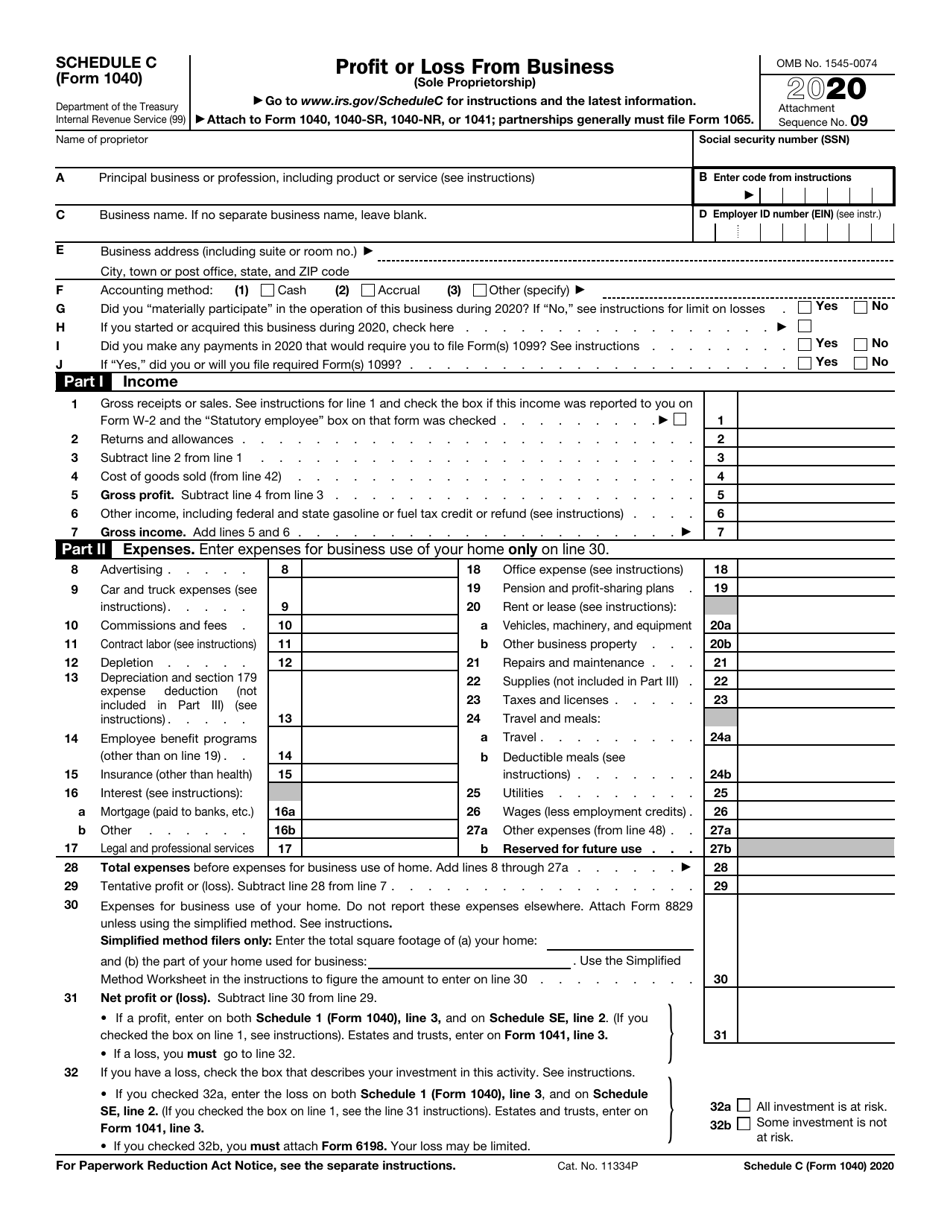

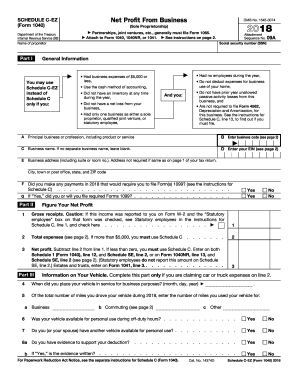

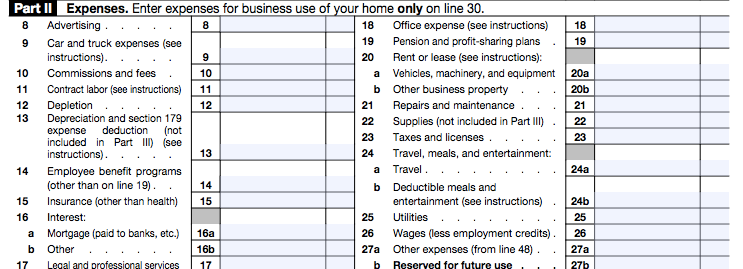

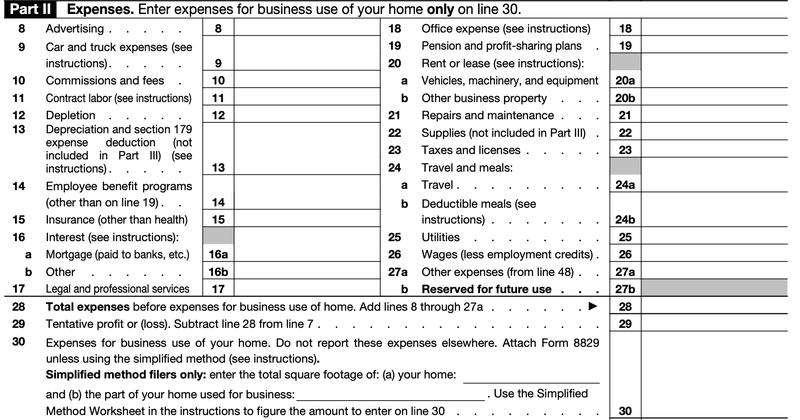

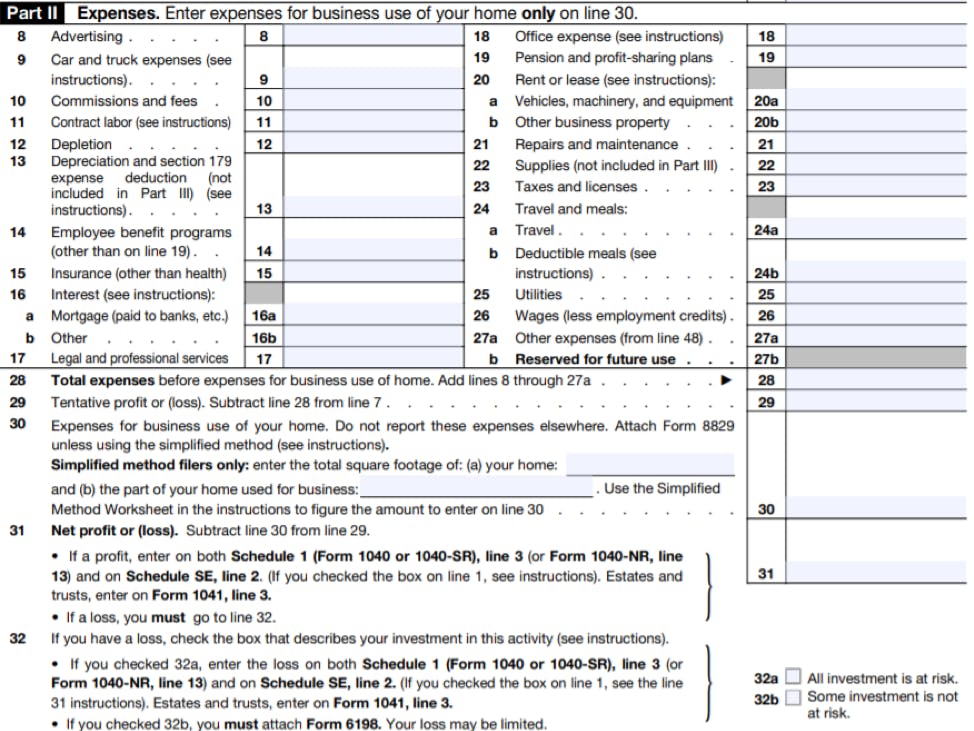

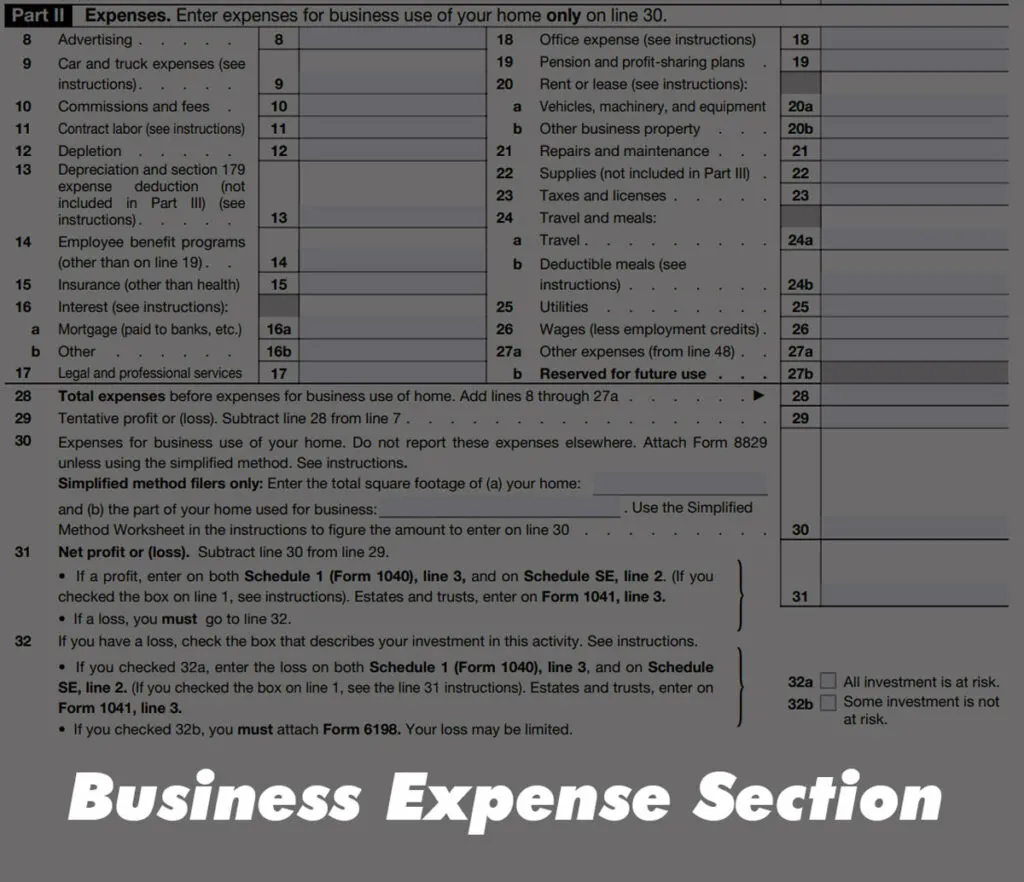

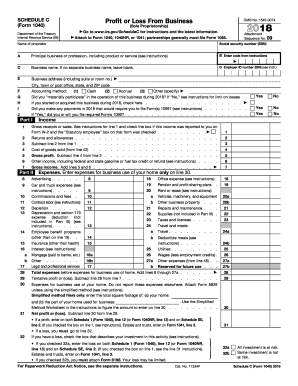

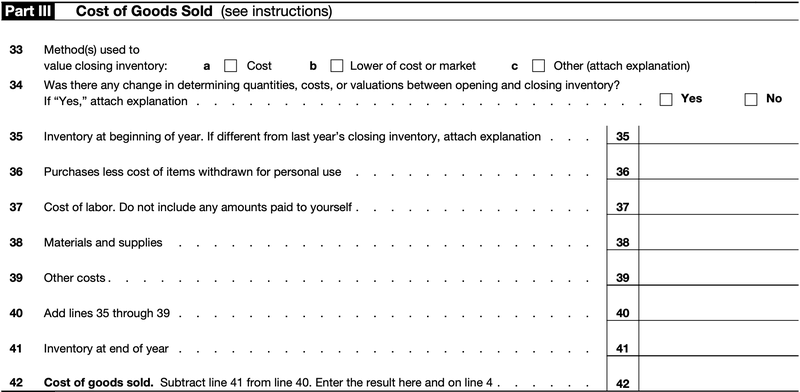

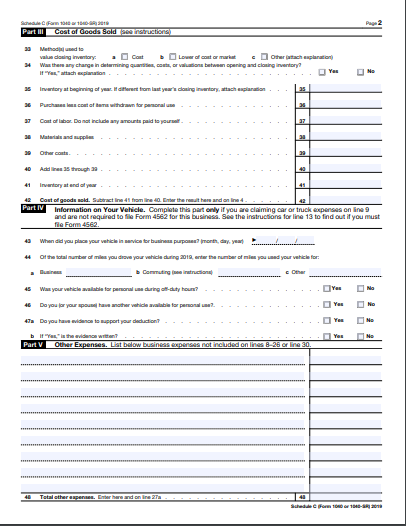

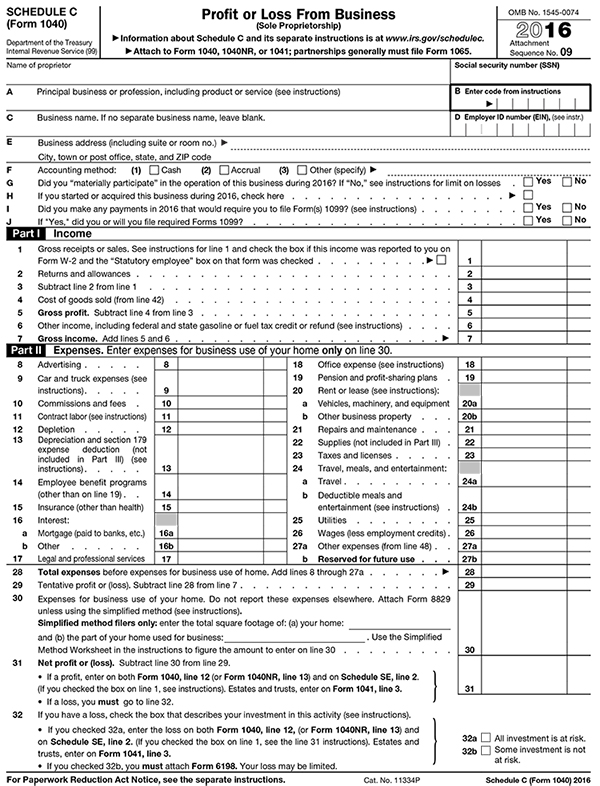

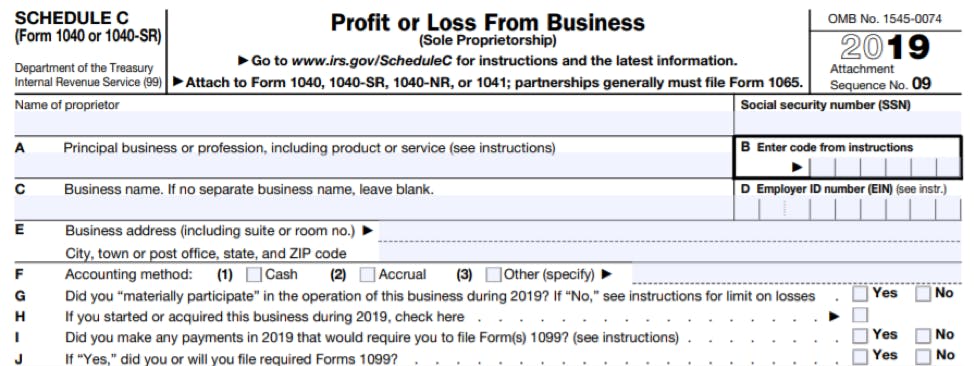

A Schedule C is a supplemental form that will be used with a Form 1040 This form is known as a Profit or Loss from Business form It is used by the United States Internal Revenue Service for tax filing and reporting purposes This form must be completed by a sole proprietor who operated a business during the tax yearClick Rent or Royalty Income to expand, Independent contractors use the Schedule C form to report business income If you're a 1099 contractor or sole proprietor, you must file a Schedule C with your taxes Your Schedule C form accompanies your 1040 and reports business income, expenses, and profits or losses If you operate a business in the Sharing Economy or if you work as an

Step By Step Instructions To Fill Out Schedule C For

Step By Step Instructions To Fill Out Schedule C For

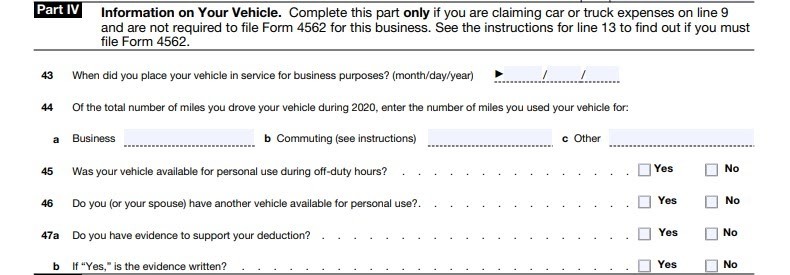

At the right upper corner, in the search box, type in schedule C and Enter ;21 Instructions for Form 1099K IRS tax forms furnishing requirements, Copies 1, B, 2, and C of Form 1099K are fillable online in a PDF format, available at IRSgov/Form1099K You can complete these copies online for furnishing statements to recipients and for retaining in your own files Frequently asked questions (FAQs) Schedule C Despite popular belief, this schedule is not just for small business owners If box 7 on Form 1099MISC has an amount for nonemployee compensation, you will need to report this income on this schedule The good news is that Part 2 of this schedule allows you to take several business deductions, like vehicle expenses, advertising

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Instructions For Form 95 A Internal Revenue Service

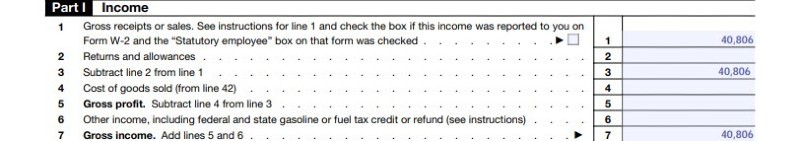

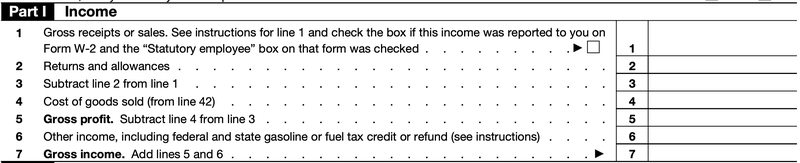

21 Inst 1099 General Instructions General Instructions for Certain Information Returns (Forms 1097, 1098, 1099, 3921, 3922, 5498, and W2G) Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21We've made it through the identity section Now let's go to the next part where we breakdown your income Part 1 IncomeSCHEDULE C (Form 1040) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) Go to wwwirsgov/ScheduleC for instructions and the latest information Sequence No Attach to Form 1040, 1040SR, 1040NR, or 1041;

How To Fill Out A Self Calculating Schedule C Profit Or Loss From Business Youtube

1

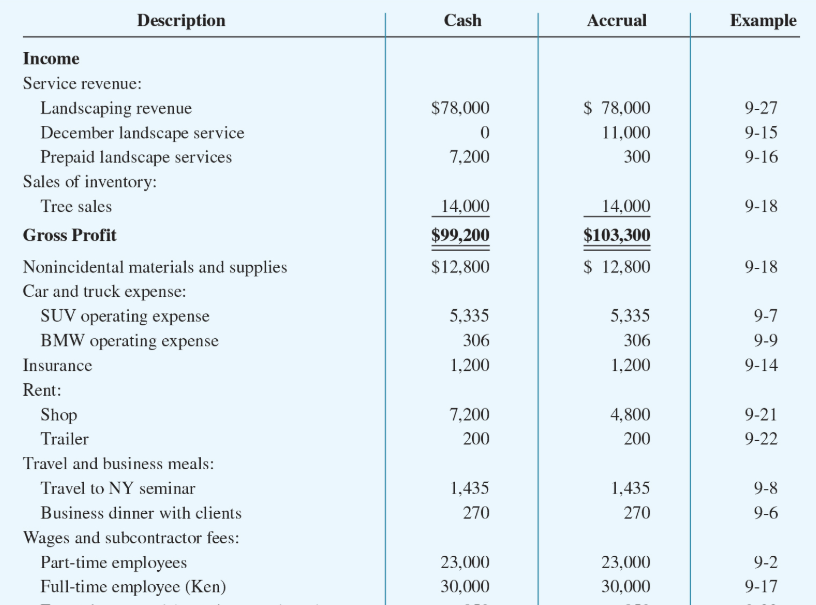

I have received a 1099 misc for 19 that includes income that I have already declared in 18 I am on a accrual accounting method and declared the majority of the 1099 income in 18 because it was invoiced in 18 The 1099 is correct as it reflects the money that was paid to me in 19Starting from 21, the previously used 1099misc forms are getting replaced with 1099NEC for nonemployee compensation This form documents your taxable income from last year made through Instacart platform, usually if you are a parttime driver If you drove full time, earned more than $,000, and had more than 0 transactions in , youIf you are required to file Form 1099C, you must provide a copy of Form 1099C or an acceptable substitute statement to each debtor In the General Instructions for Certain Information Returns, see Part M for more information about the requirement to furnish a

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

Irs Form 1040 Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship Templateroller

Schedule C 1099 MISC Form Others by Loha Leffon This form is used by the IRS to make sure the cash continues to be correctly reported towards the tax company and that there's no discrepancy or ambiguity about what quantity was received 0603 AM 1040 AM You dont need the 1099 to report Sch C income, just enter all business income on Line 1 of the Sch C (since most self employed people have income in addition to the 1099 anyhow), as long as all income gets reported, that's all thats needed 0416 PM Updated Schedule C on Form 1040 is a tax document that must be filed by people who are selfemployed It is a calculation worksheet known as the "Profit or Loss From Business" statement This is where selfemployed income from the year is entered and tallied, and any allowable business expenses are deducted

1099 Nec Schedule C Won T Fill In Turbotax

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

Partnerships generally must file Form 1065 OMB No Attachment 09Answer that this did not involve an intent to earn moneyForm 1099MISC, Miscellaneous Income Taxpayers may receive other business income on Form 1099MISC, Boxes 2 and 3 Refer to Schedule C instructions for more information Form 1099K, Payment Card and Third Party Network Transactions Form 1099K is used by thirdparty networks (such as Visa, Mastercard, or others) to report transactions

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Schedule C Form 1040 Free Fillable Form Pdf Sample Formswift

Incentive payments are still taxable income and must still be included on Schedule 1 of the Form 1040—the return you'll file in 21 But they're not taxed in quite the same way as earnings that appear in Box 1 of Form 1099NEC, "Nonemployee Compensation"2 days ago Transcribed image text Cuand Mary Form 1099INT Mary's Form Form 1099G Form 1040 Schedule 1 Tax Table Instructions Carl Conch and Mary Duval are married and file a joint return Carl works for the Key Lime Pie Company and Mary is a unemployed after losing her Job in 19 Carl's birthdate is and Mary's isForm 1099C (entitled Cancellation of Debt) is one of a series of "1099" forms used by the Internal Revenue Service (IRS) to report various payments and transactions, excluding employee wages

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Form 1099 Nec Nonemployee Compensation 1099nec

1099NEC Snap and Autofill Available in TurboTax SelfEmployed and TurboTax Live SelfEmployed starting Available in mobile app only Feature available within Schedule C tax form for TurboTax filers with 1099NEC incomeIf you are filing a 1099NEC with income in Box 1, you will be prompted to add the income to an existing Schedule C or create a new Schedule C after completing the 1099NEC entry If you receive a 1099K, the IRS requires this income to be reported as income on the Schedule C For more information about the 1099K, please click hereInst 1040 (Schedule C) Instructions for Schedule C (Form 1040 or Form 1040SR), Profit or Loss From Business (Sole Proprietorship) Form 1065 (Schedule C) Additional Information for Schedule M3 Filers 1214

Irs Form 1040 Schedule E Download Fillable Pdf Or Fill Online Supplemental Income And Loss Templateroller

The Ultimate Guide To Irs Schedule E For Real Estate Investors

The IRS also considers consulting or contractor income as business income that needs to be entered on a Schedule C Most selfemployment income is reported on Form 1099NEC or Form 1099MISC If you have selfemployment income reported on either of these forms, you will need to enter the income on a Schedule C Type in "schedule c" (or for CD/downloaded TurboTax, click Find) Click on "Jump to schedule c" Click on the blue "Jump to schedule c" link If you already have created a Schedule C in your return, click on edit and go to the section to Add Income This is where you will reenter the Form 1099NECProfit or Loss from a Business, report on a Schedule C *Effective Tax Year the 1099MISC is no longer used to report nonemployee compensation Box 7 For tax year , i s a check box, If checked, $5000 or more of direct sales of consumer products was paid to you a buyer (recipient) for resale A dollar amount does not have to be shown

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

What Is A Schedule C Tax Form H R Block

After 38 years of absence, Form 1099 NEC made its return in the tax year With Form 1099 NEC, employers can report nonemployee compensation through revived Form and goodbye to reporting nonemployee compensation on Form 1099 Online MISC Form So, more over Form 1099 MISC doesn't report nonemployee compensation Form 1099 NEC is a formFollow the instructions below to correctly enter the Form 1099NEC and linked it to the proper Schedule 1 Click Add Form (Ctrl A) 2 Select FRM 1099NEC Nonemployee Compensation 3 Complete the required fields (check Verify messages) 4 Select the Link to (1040, Sch C, or F) field, and choose Choices (F3 for shortcut) from the active Beginning with the tax year, the Form 1099MISC deadline is March 1 if you file on paper and March 31 if you file electronically Beginning with tax year , Form 1099NEC must be filed by January 31 of the following year whether you file on paper or electronically

:max_bytes(150000):strip_icc()/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

1

In 22, the rules for Form 1099K will change The payee must be issued a Form 1099K if the service processed more than $600 worth of payments regardless of the number of individual payments or transactions Taxation of amounts from Form 1099K Most individuals' 1099K form reports payments to their trade or businessThe 1099MISC form is a form that reports an individual's extra earnings, aside from the salary paid by their employer The employer must generate a 1099MISC form and send it to his employee by January 31st, so that the employee can use it when filling his yearly taxes to the IRS (Internal Revenue Service) You would need to file a Schedule C and pay SE taxes You may also enter any expenses related to your work to reduce your income To file a Schedule C, here are the steps Sign in to your account and select Pick up where you left off;

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

:max_bytes(150000):strip_icc()/1099c-5606545f559b4f28883a0de35905889b.jpg)

Form 1099 C Cancellation Of Debt Definition

Payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax If your net products on Schedule C (Form 1040 or 1040SR) If you receive a form 1099MISC for a settlement, then you are not considered as selfemployed and do not need to file a Schedule C In TurboTax, enter your form 1099MISC and follow the interview until you arrive at the page titled Did this involve an intent to earn money?

Filling Out Irs Schedule C For The 1040 Youtube

1 The Image Shows A Completed Schedule C Using The Chegg Com

How To Fill Out Schedule C If You Re Self Employed 17 Youtube

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc Ppp Loan Forgiveness Schedule C Youtube

How To Fill Out Schedule C For Business Taxes Youtube

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To File Schedule C Form 1040 Bench Accounting

Deducting Business Meals Other Expenses On Schedule C Don T Mess With Taxes

Tax Documents That Every Freelancer And Contractor Needs Form Pros

1

Profit Or Loss From Business Sole Proprietorship Irs Tax Form 1040 Schedule C 16 Package Of 100 U S Government Bookstore

Ppp Second Draw Application Tutorial Self Employed Schedule C 1099 No Employees Homeunemployed Com

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

18 21 Form Irs 1040 Schedule C Ez Fill Online Printable Fillable Blank Pdffiller

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

What Is An Irs Schedule C Form And What You Need To Know About It

Ppp Application Guide For Gig Workers Self Employed Sba Ppp Loan

What Is A Schedule C Stride Blog

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

1040 Schedule C Instructions

Step By Step Instructions To Fill Out Schedule C For

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

What Is Irs Form 1099 Misc Miscellaneous Income Nerdwallet

Step By Step Instructions To Fill Out Schedule C For

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

Www Irs Gov Pub Irs Pdf I1099msc Pdf

What Are The Required Documents For A Ppp Loan Faq Womply

Www Irs Gov Pub Irs Pdf F1040sf Pdf

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Free 9 Sample Schedule C Forms In Pdf Ms Word

Doordash Taxes Schedule C Faqs For New Experienced Dashers

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

Walk Through Filing Taxes As An Independent Contractor

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

:max_bytes(150000):strip_icc()/ScheduleC-22b719c014fd419b89315bb420243dcf.jpg)

Irs Schedule C What Is It

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Www Irs Gov Pub Irs Pdf I1040sc Pdf

1 The Image Shows A Completed Schedule C Using The Chegg Com

Irs Form 1040 Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship Templateroller

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart

Irs Form 1040 Schedule C

Form 1099 Misc Vs Form 1099 Nec How Are They Different

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

Ppp Loans And The Self Employed Schedule C And Schedule F Scheffel Boyle

1040 Schedule C 21 Schedules Taxuni

Filing A Schedule C For An Llc H R Block

1040 Schedule C Form Fill Out Irs Schedule C Tax Form

Form 1099 Nec Nonemployee Compensation 1099nec

1099 Misc Form Fillable Printable Download Free Instructions

Www Guidestone Org Media Guidestone Corporate Ministry Tools Mintaxguide 2112 Mintaxguidesec4 Pdf La En

Profit Or Loss From Business Sole Proprietorship Irs Tax Form 1040 Schedule C 16 Package Of 100 U S Government Bookstore

Irs Schedule C Instructions Schedule C Form Free Download

How To File Schedule C Form 1040 Bench Accounting

:max_bytes(150000):strip_icc()/Form1040-651873f7a52b48edad115da1b595ad00.jpg)

Other Income On Form 1040 What Is It

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How Do I Link To Schedule C On My 1099 Misc For Bo

Free 9 Sample Schedule C Forms In Pdf Ms Word

Taxslayer 21 Tax Year Review Pcmag

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

1 The Image Shows A Completed Schedule C Using The Chegg Com

Www Irs Gov Pub Irs Pdf F1040sc Pdf

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Ppp Guide For Self Employed Schedule C 1099 Covid Chai 1

Ppp Faqs 1040 Schedule C Tips For Independent Contractors Sole Proprietors And Self Employed

What Are The Required Documents For A Ppp Loan Faq Womply

Doordash 1099 Taxes And Write Offs Stride Blog

How A 1099 C Affects Your Taxes Innovative Tax Relief

1 The Image Shows A Completed Schedule C Using The Chegg Com

Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income 4012 Pdf

1

Form 1099 Nec For Nonemployee Compensation H R Block

Publication 559 Survivors Executors And Administrators Internal Revenue Service

0 件のコメント:

コメントを投稿