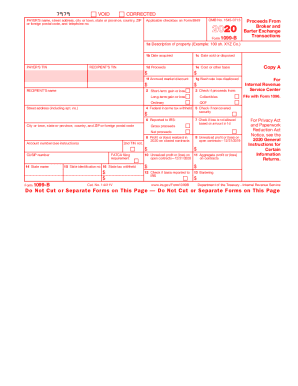

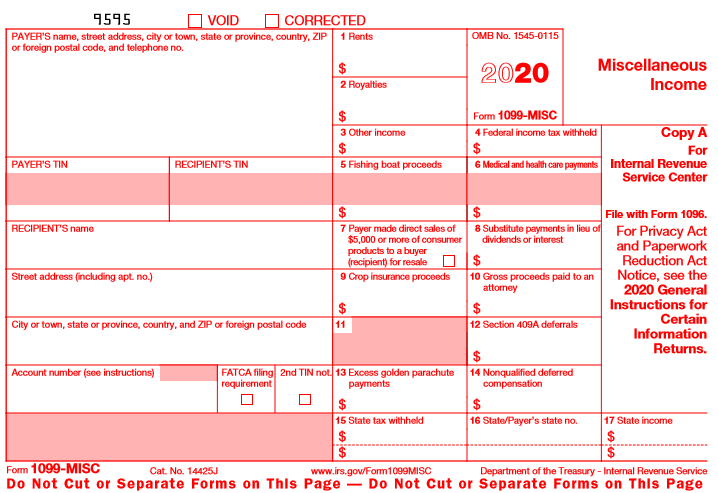

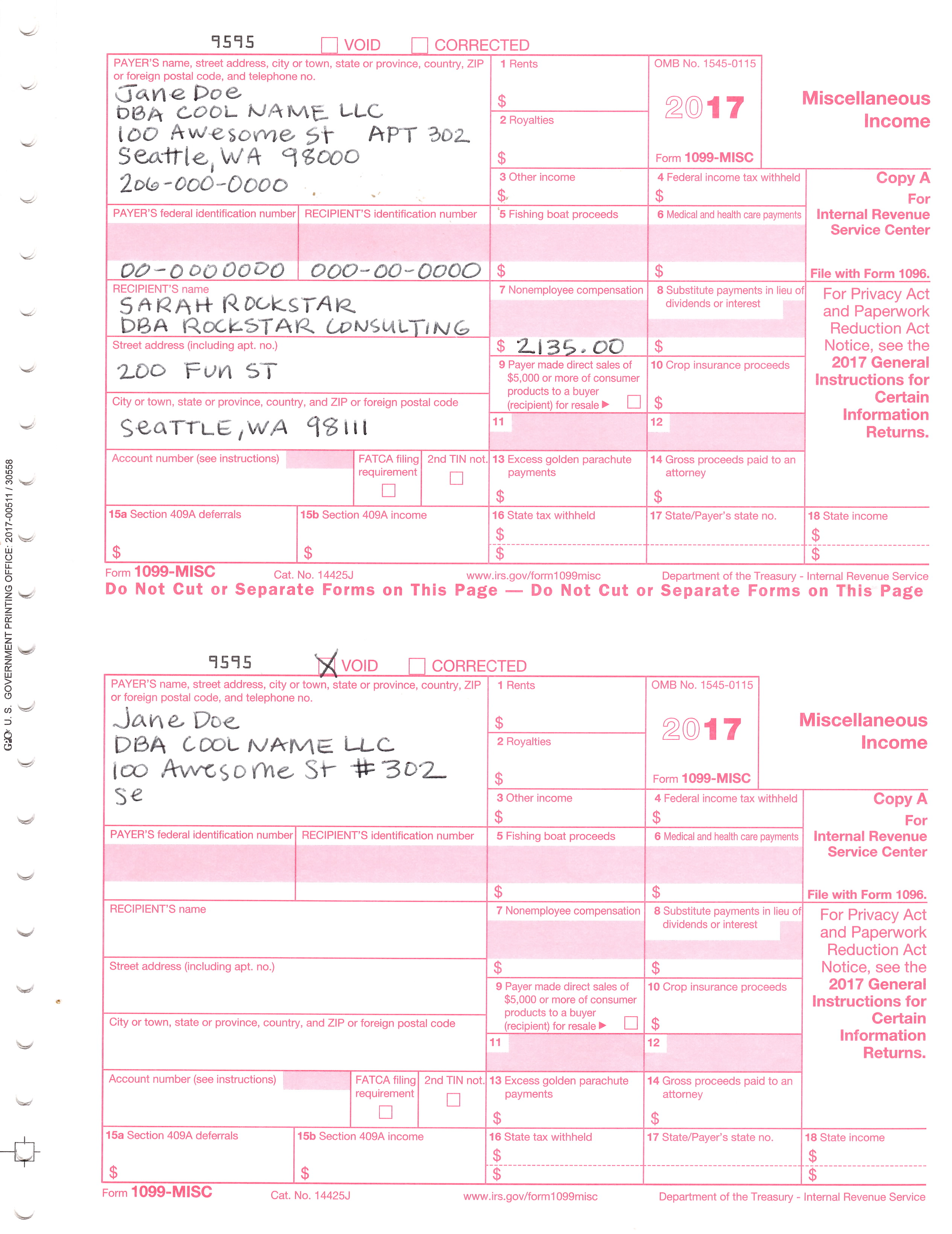

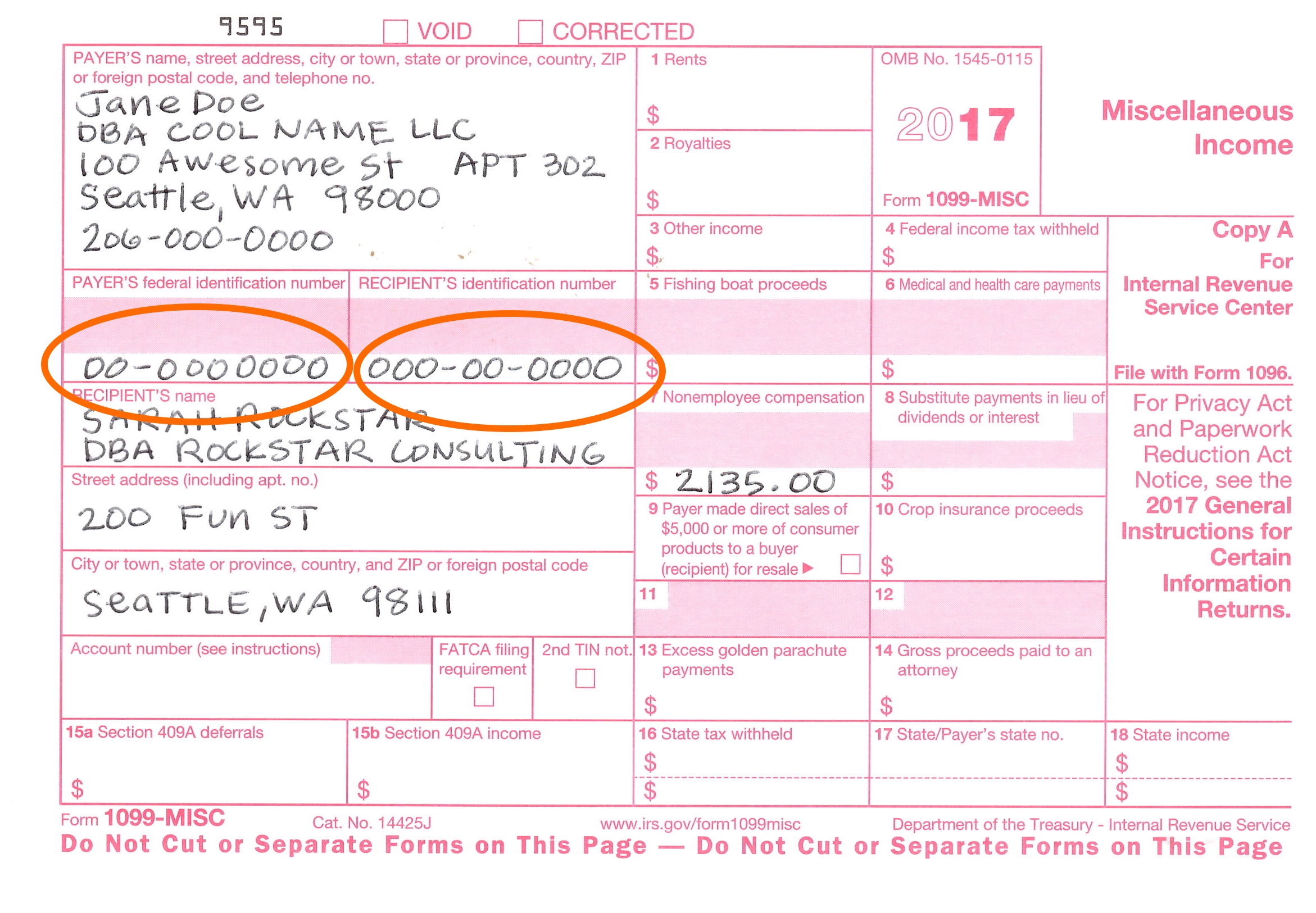

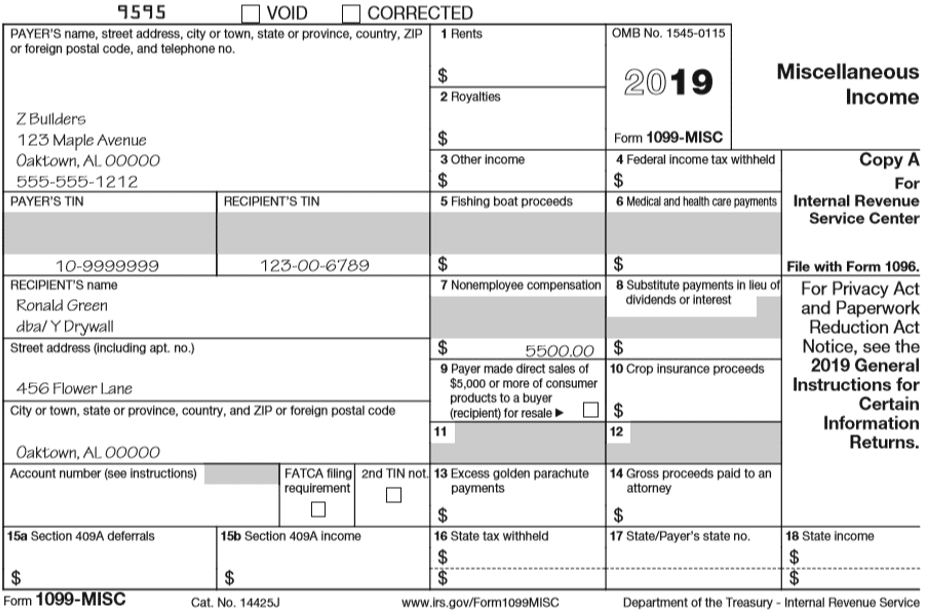

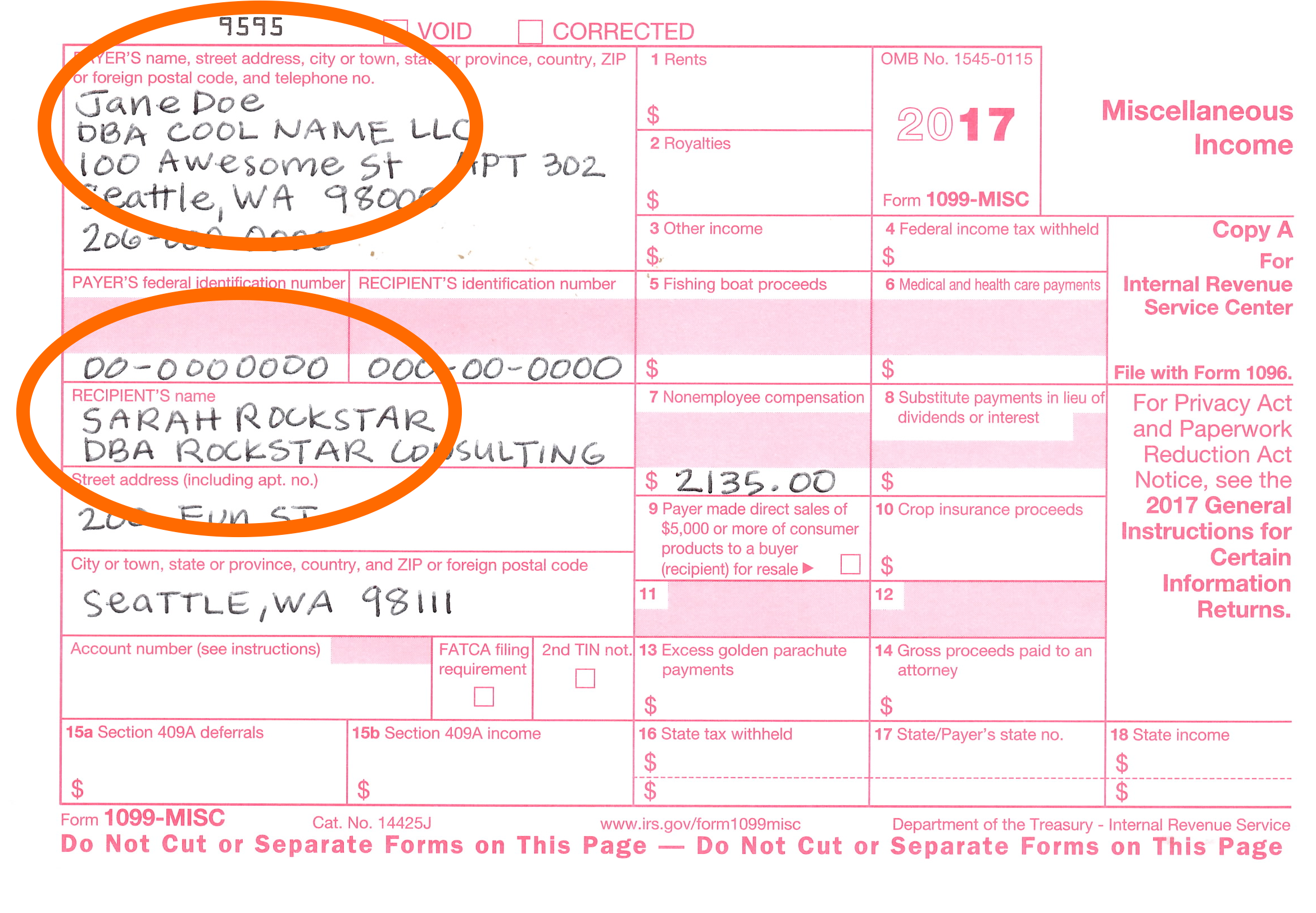

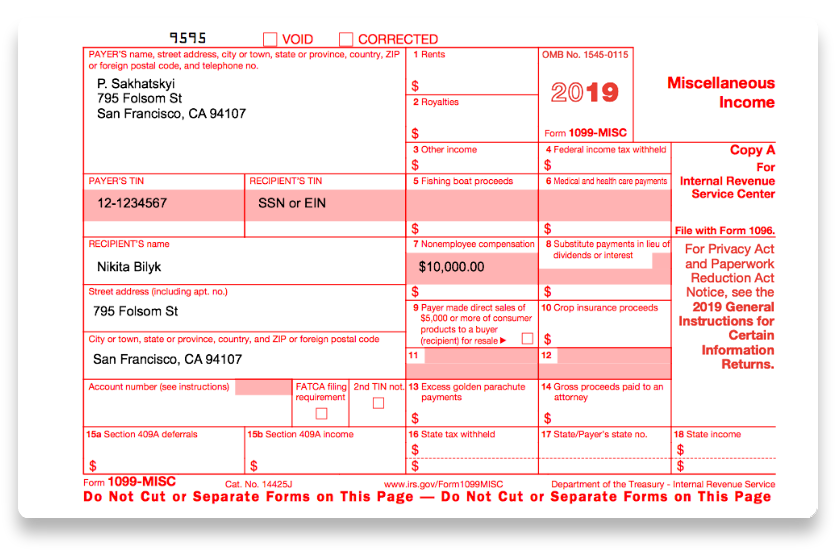

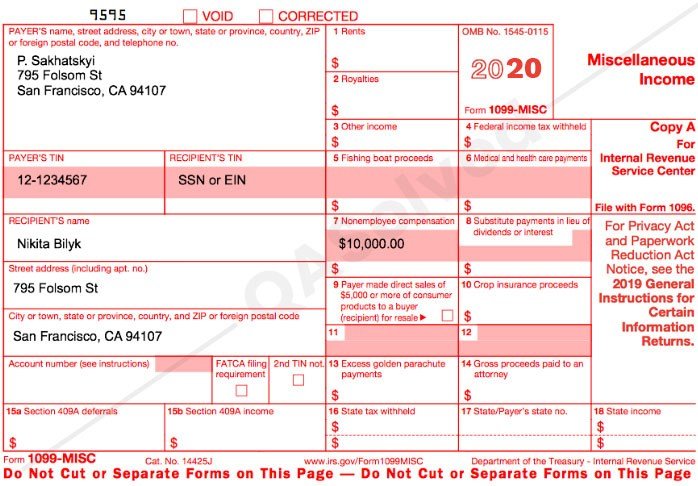

· Before you fill out a 1099MISC form, ensure that you order Form 1099MISC online or by phone Payer and recipient information In the unnumbered boxes on the top of the form, specify your business' name, street address, city or town, state or province, country and ZIP code and telephone number Below, specify your business' taxpayer identification number and your · Sample of completed 1099 MISC form click for larger image Corporations Do I need to issue 1099 forms for payments made to corporations?Free Printable 1099 MISC Form Online1099 Misc Form is used to report various types of Miscellaneous Income 1099 information return is provided by payers to individuals like independent contract works to report payments made during the total year A 1099 Miscellaneous Form must be given to nonemployees to whom $600 or more has been paid during the calendar

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

How to fill in 1099 misc form

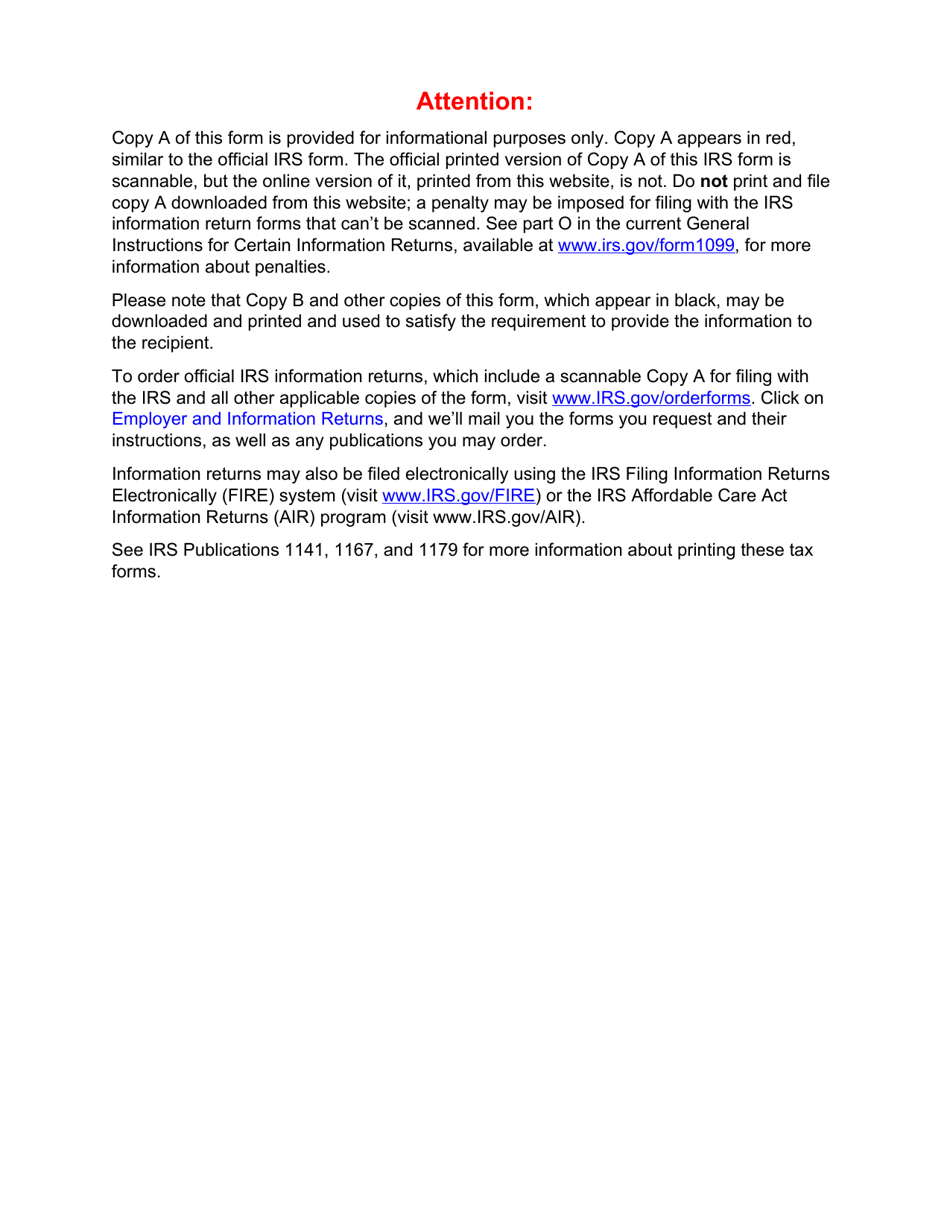

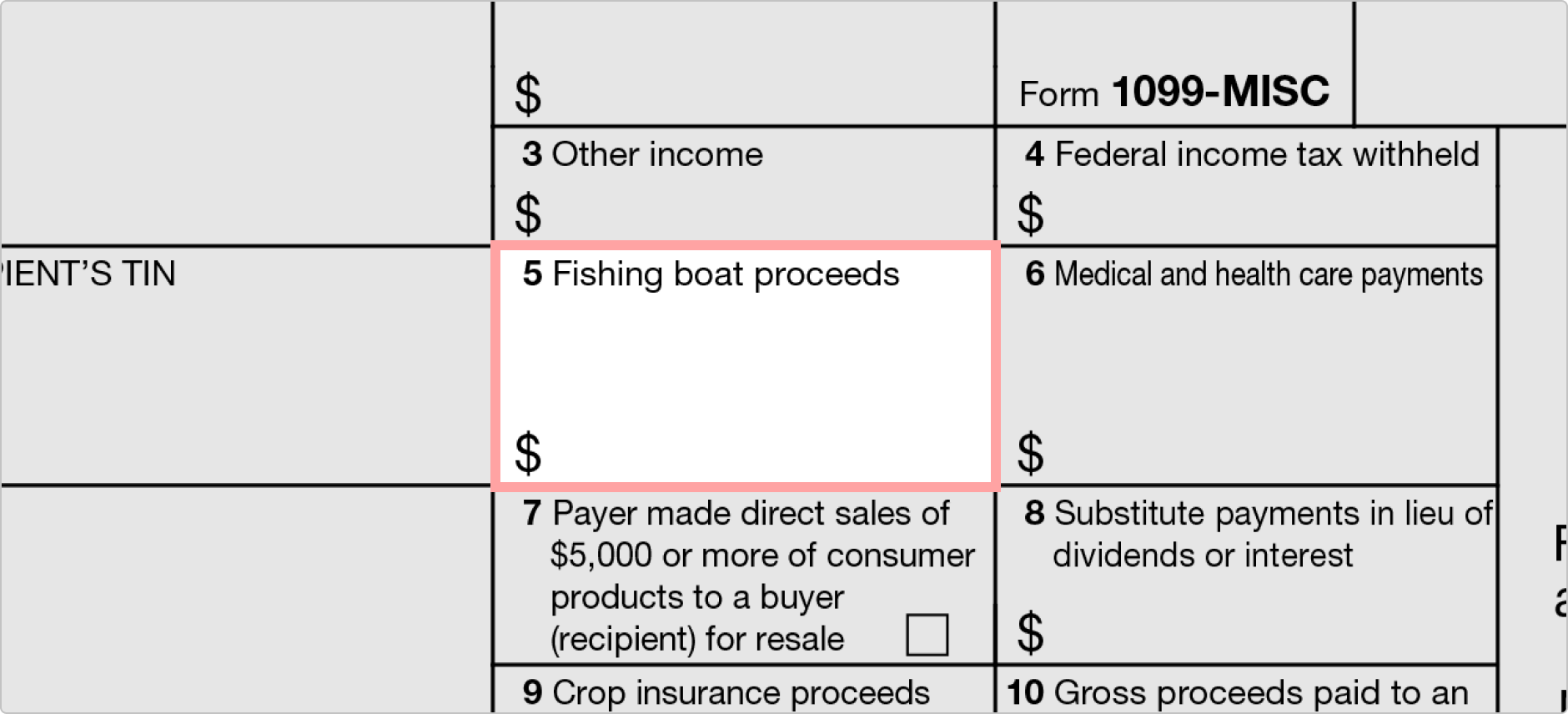

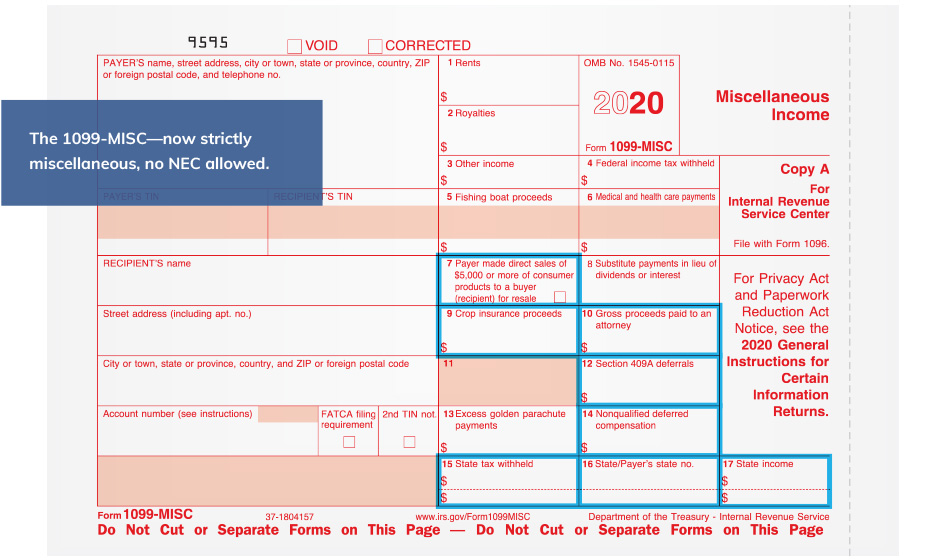

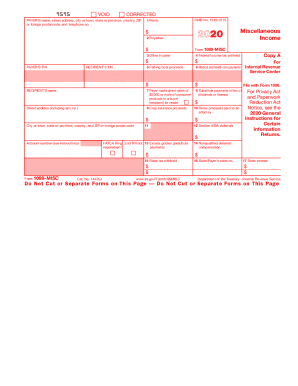

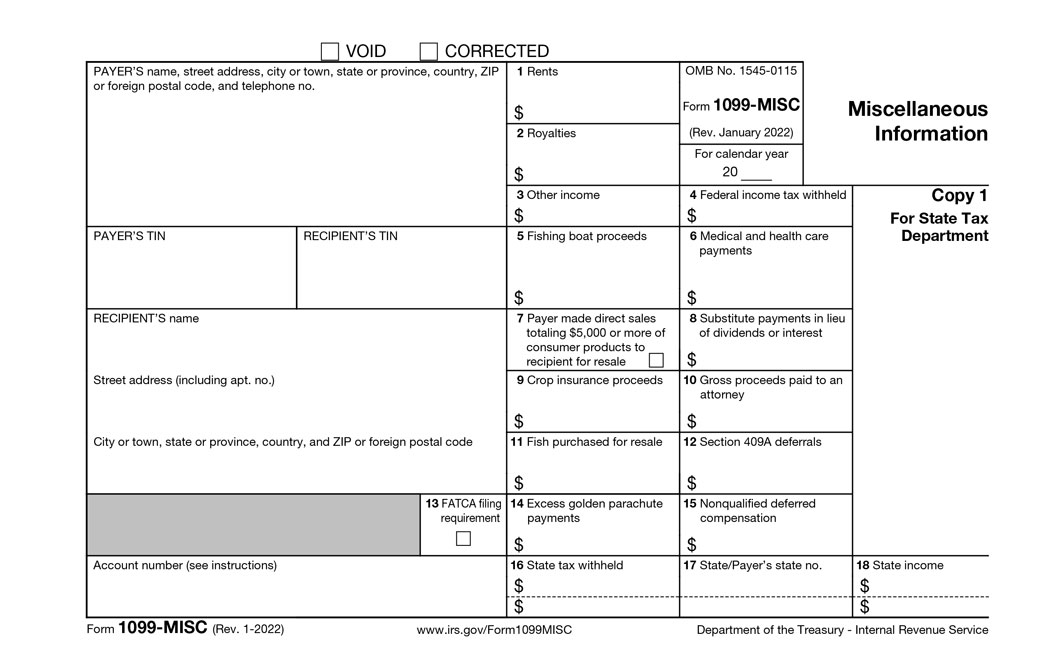

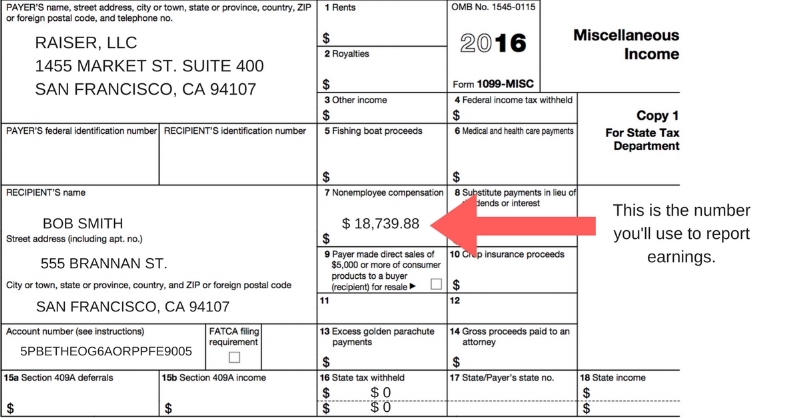

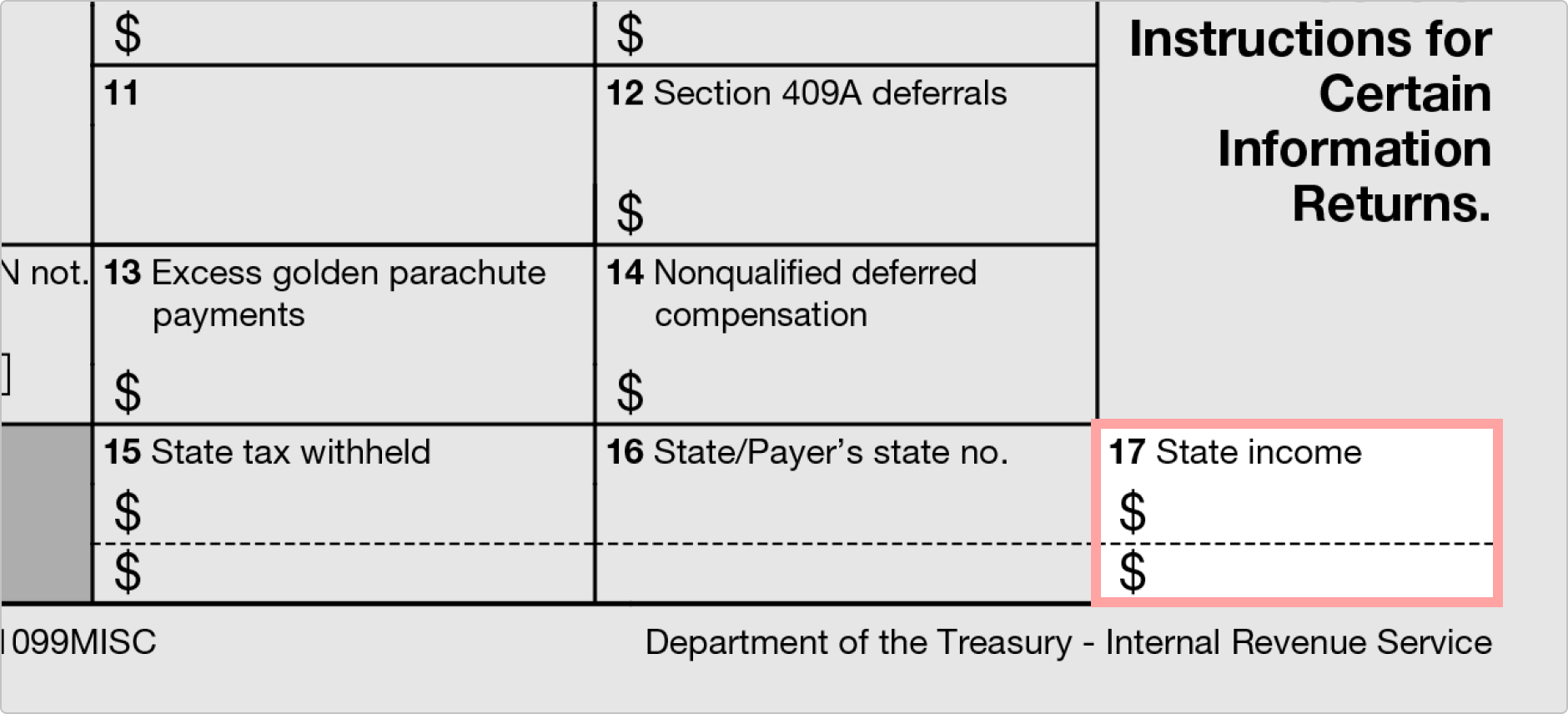

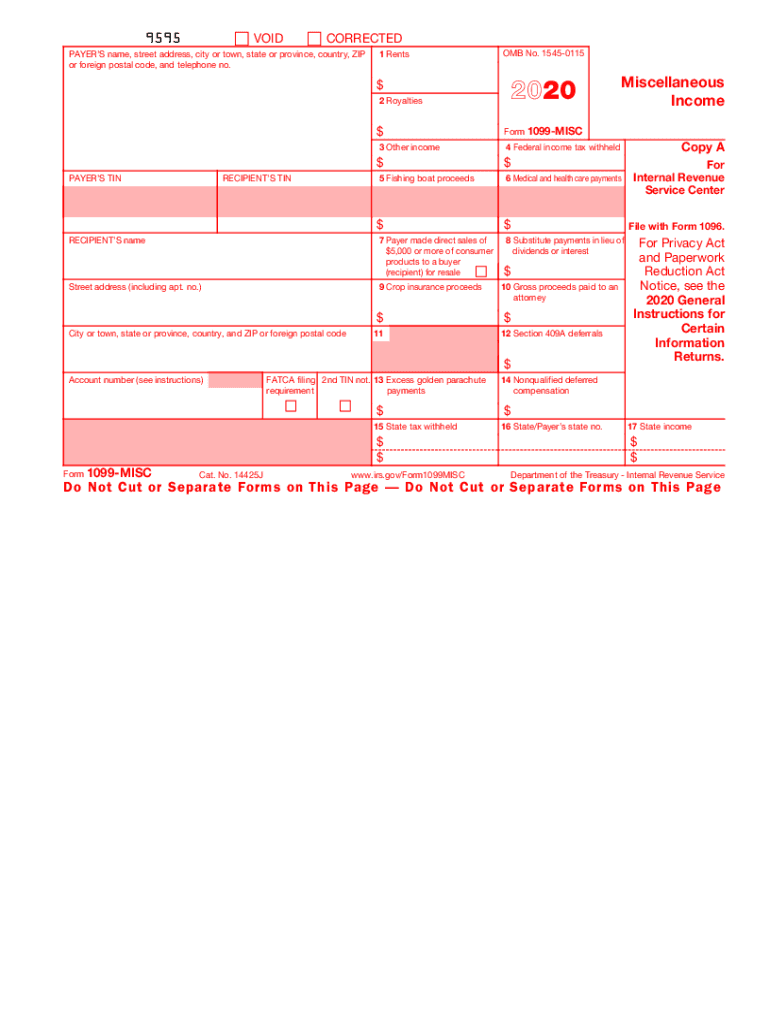

How to fill in 1099 misc form-Form 1099MISC Miscellaneous Income Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No VOID CORRECTED PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no PAYER'S TIN RECIPIENT'S TIN RECIPIENT'S name Street address (including apt no) City orForm 1099MISC Miscellaneous Income (or Miscellaneous Information, as it's called starting in 21) is an Internal Revenue Service (IRS) form used to report certain types of miscellaneous

1099 Misc Public Documents 1099 Pro Wiki

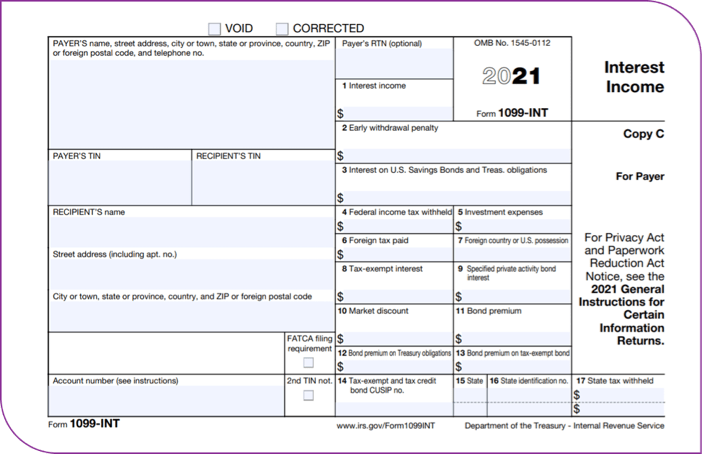

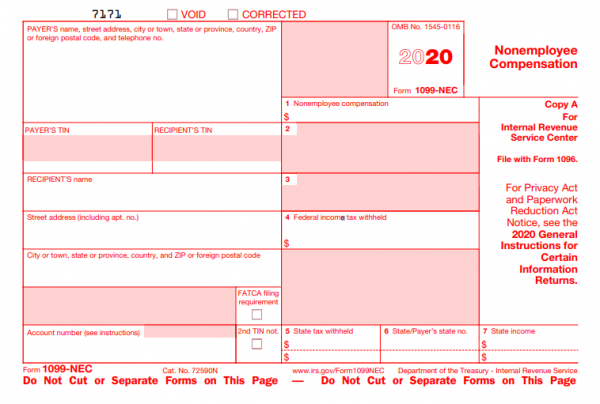

1099 MISC FormYear End Tax Reporting Form 1099 MISC is a version of Form 1099 and is used to report miscellaneous income One main use of 1099 Miscellaneous Form is to report payments paid by a payer Payments including nonprofits to a noncorporate US resident independent contractor for services In IRS terminology, such income is nonemployeeH 1099 Sample Forms This appendix includes the following sample forms Appendix H, "1099 Miscellaneous Income (Updated for 1099)" Appendix H, "1099 Nonemployee Compensation" Appendix H, "1099 Dividends and Distributions (Updated for 1099)" Appendix H, "1099 Interest Income" These forms are for informational purposes only(1) 1099MISC Form Copy A (Red ink, 2Up) (2) 1099MISC Form Copy B (Black ink, 2Up) (3) 1099MISC Form Copy C (Black ink, 2Up) Need helping choosing the right forms?

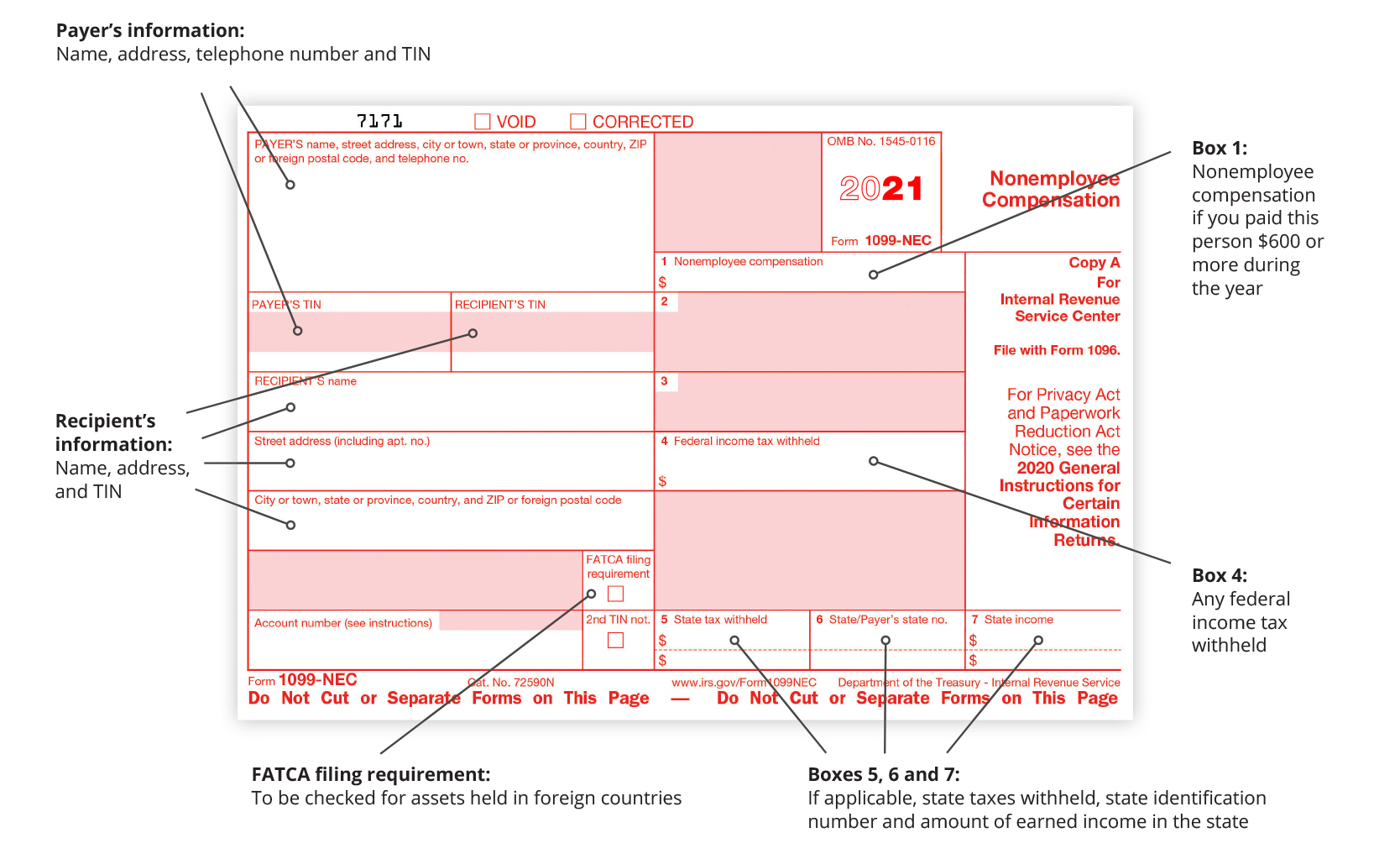

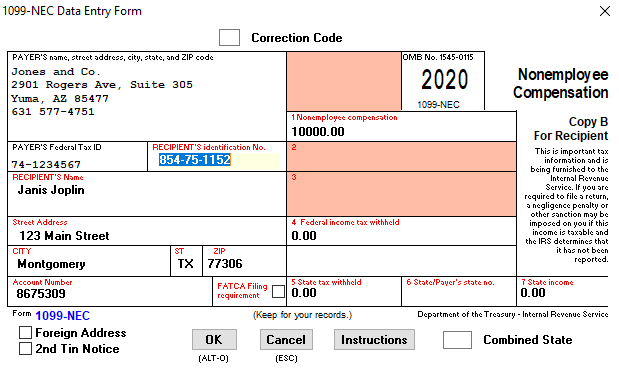

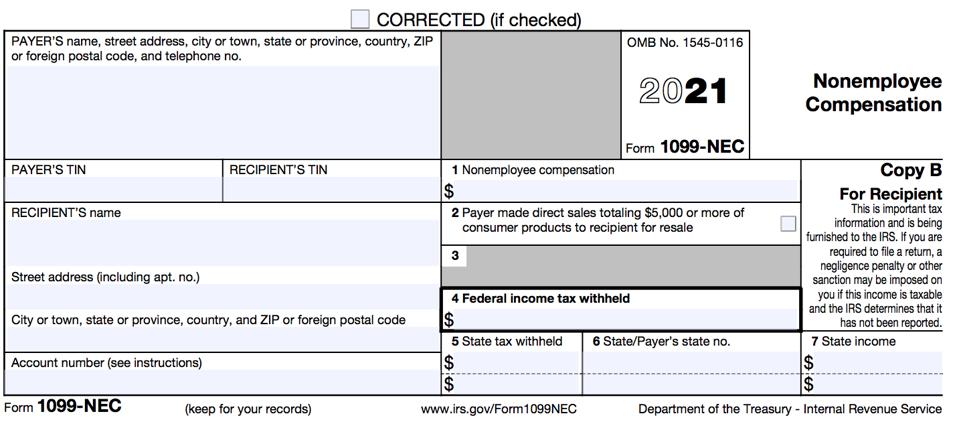

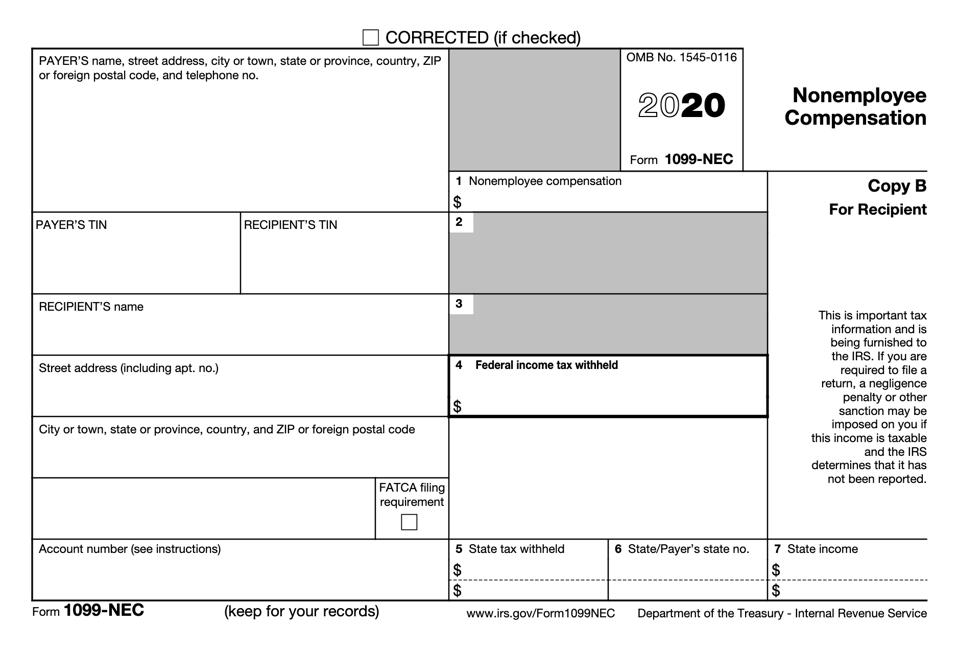

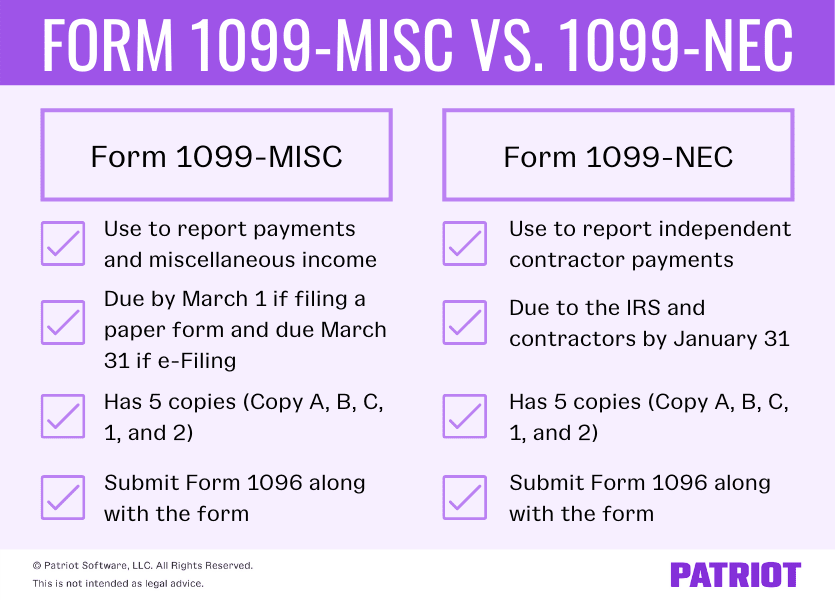

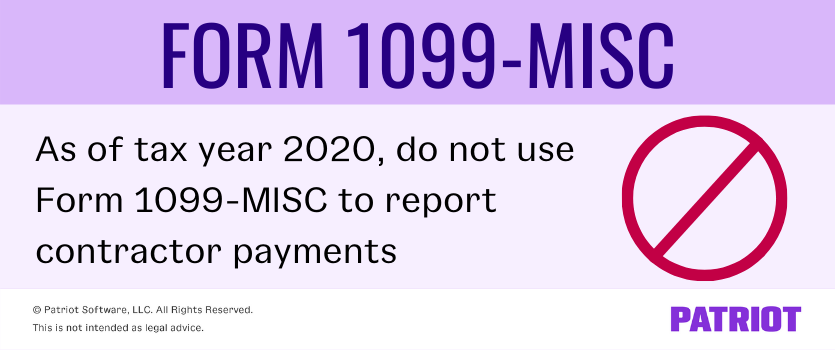

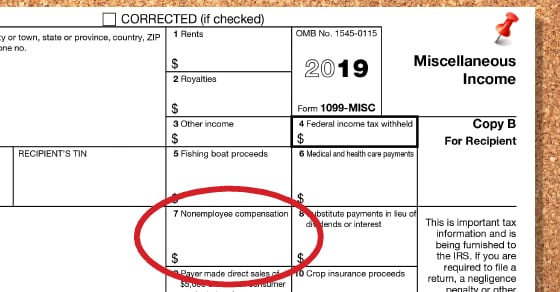

More than 70% of filers in 19 reported information in Box 7 of form 1099MISC This year, the IRS is requiring those filers to use form 1099NEC instead of 1099MISC If you need to report nonemployee compensation for the tax year, you will need to use the 1099NEC form ***All tax forms currently in stock! · Form 1099MISC vs Form 1099NEC Beginning with the tax year, you must use two different forms to report different types of payments The two forms are similar, but due dates are differentIf your business has made miscellaneous payments amounting to at least $600 or more, then you must report such payments to the IRS by filing Form 1099MISC 1099MISC Due Date 21 and Important Dates The IRS has recently announced that all 1099 forms must be filed on or by the 31st of January 21

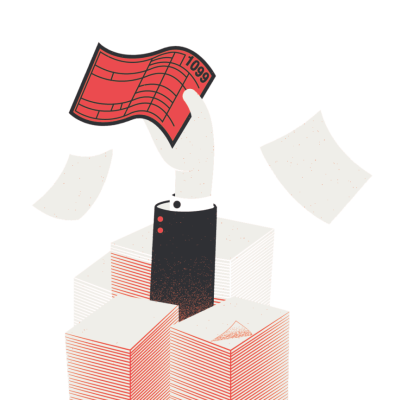

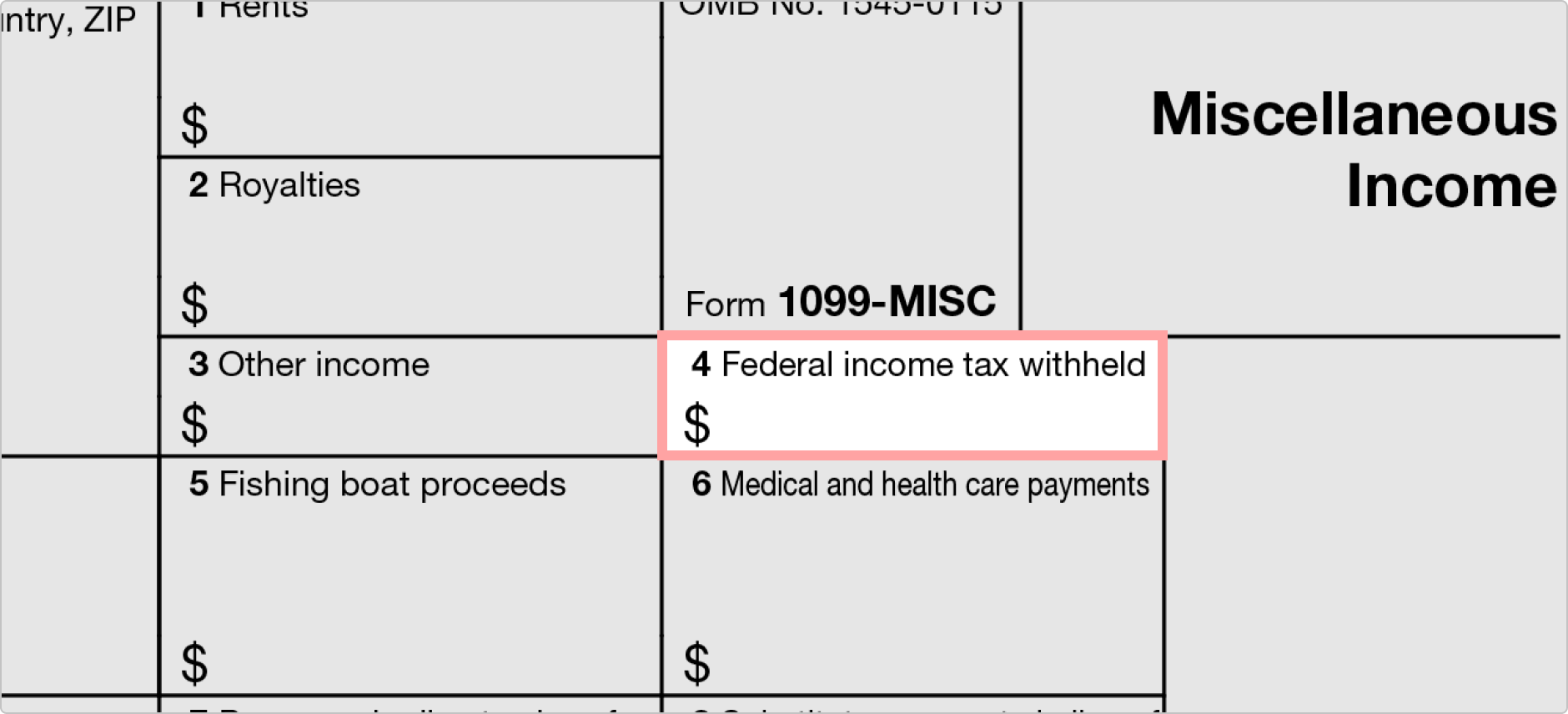

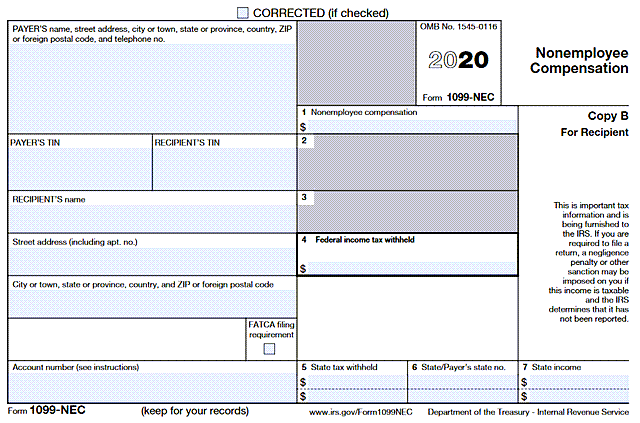

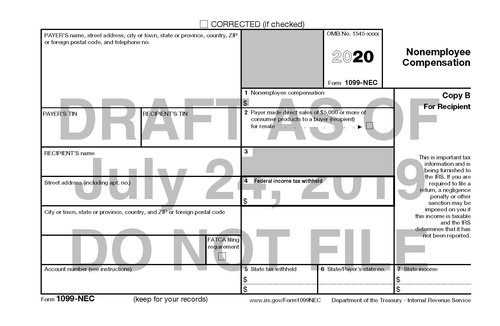

/11/ · The IRS has introduced Form 1099NEC for the tax year, making a distinction between payments to nonemployees and other types of miscellaneous payments a business might make The form doesn't replace Form 1099MISC It just separates payments made to nonemployees onto this different form for reporting purposesThis year, the IRS is requiring those filers to use form 1099NEC instead of 1099MISC If you need to report nonemployee compensation for the tax year, you will need to use the 1099NEC form NOTE We are now taking orders for 21 tax forms to be shipped in August tax forms are no longer availableReported on Form 1099MISC for additional tax calculation See the Instructions for Forms 1040 and 1040SR, or the Instructions for Form 1040NR Box 2 Reserved Box 3 Reserved Box 4 Shows backup withholding A payer must backup withhold on certain payments if you did not give your TIN to the payer See Form W9, Request for Taxpayer Identification Number and

Slopup5yyxohcm

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

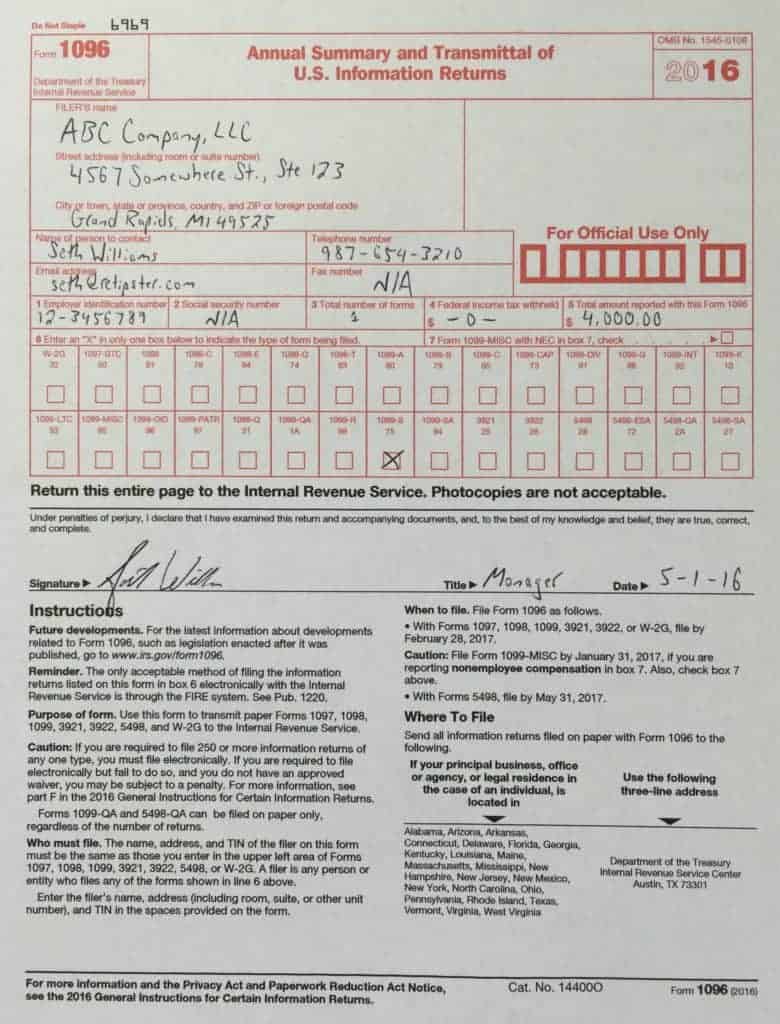

24 X 7 Customer Support;No, in general you do not need to issue 1099 forms for payments you made to a corporation For instance, if you pay a corporation that, say, provides Web design services or some other business service, you do not need to issue a 1099 · You must send the contractors and the IRS a Form 1099MISC—or, starting in tax year , a () web page gives a complete list of due dates If a due date falls on a Saturday, a Sunday, or a legal holiday, the due date is the next business day Form 1096 for State Taxes You may need a file a 1096 with corresponding 1099s for state taxes For example,

Order 1099 Nec Misc Forms Envelopes To Print File

1099 Misc Form Fillable Printable Download Free Instructions

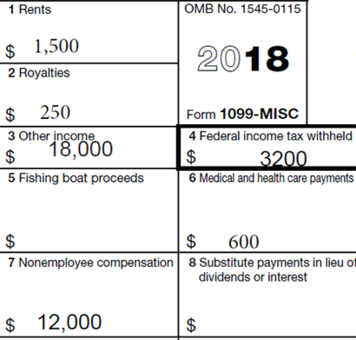

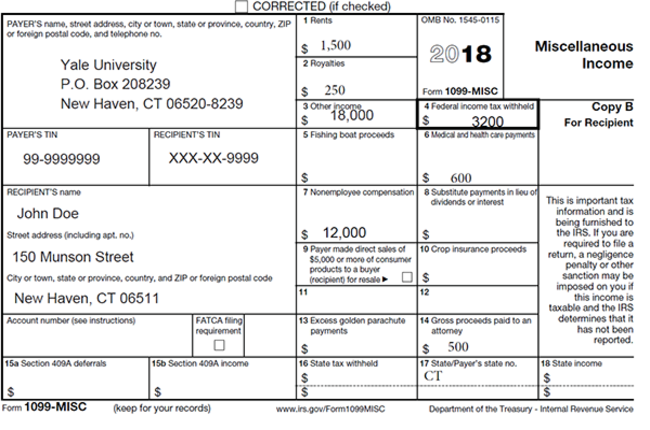

Toggle navigation Create Pay Stub;/12/ · The 1099NEC is new for tax filing year If you paid contractors previously using 1099MISC, we suggest moving to the new 1099NEC The 1099NEC makes your filing very specific about the type of payment (in this case, contractor income or other service income you paid) Otherwise, the forms are essentially similar except for the types of payments where each apply To file using form 1099103 1099MISC Form This section provides a sample of the 1099MISC form, which you use to report miscellaneous income 1031 1099MISC Form Sample These are examples of 1099MISC forms for 19 Figure 103 Example of the 1099MISC form for 19 Preprinted Version Description of ''Figure 103 Example of the 1099MISC form for 19 Preprinted Version'' Figure 104 Example of the 1099

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Form 1099 For Nonprofits How And Why To Issue One Jitasa Group

EFile a 1099 form with IRS 1099 Forms Supported 1099NEC, 1099MISC, 1099A, 1099div, 1099INT, 1099K and 1099R Trusted by 95,000 Businesses1099NEC, new form starting Formerly Box 7 of 1099MISC 2 1099MISC, Common version Box 3 OTHER INCOME plus Rents and Royalties 3 ATTORNEY 1099MISC Box 3 Other Income plus Attorney & Medical Payments Perfect for attorneys 4 1099Form 1099MISC 21 Miscellaneous Information Copy B For Recipient Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported OMB No 1545

Printable 1099 Misc Forms Fill Out And Sign Printable Pdf Template Signnow

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

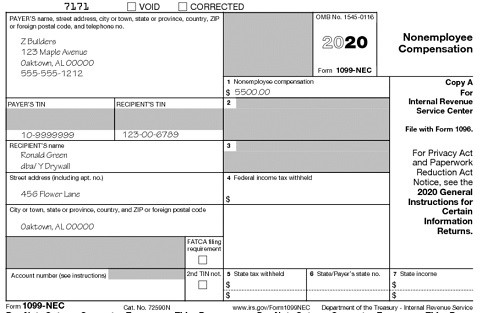

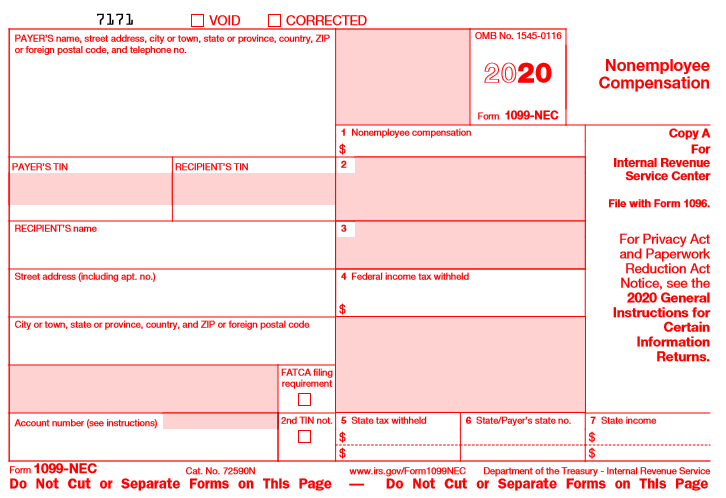

Sample 1099NEC The 1099NEC is being introduced for tax year Previously, these amounts were reported on Box 7 of the 1099MISC To read a brief description of a box on the 1099NEC, move your mouse pointer over a box in the sample form · Note that the 1099NEC is new for tax filing year If you paid contractors previously using 1099MISC, we suggest moving to the new 1099NEC The 1099NEC makes your filing very specific about the type of payment (in this case, contractor income or other service income you paid) Otherwise, the forms are essentially similar except for the types of paymentsForm 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or trade The independent contractors need to report

1099 Misc Form Fillable Printable Download Free Instructions

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

· 1099 MISC Form is now available online Make Form MISC by filling basic details & is here for instant download & use Ease tax season with 1099 MISC with Stub Creator Feel free to ask any question support@stubcreatorcom;How to fill out form 1099misc?Get the BUSINESS SPREADSHEET TEMPLATE for your selfemployed or LLC accounting & taxes here http//wwwamandarussellmba/gettAll tax orders process and ship in 12 business

1099 Misc Form Fillable Printable Download Free Instructions

1099 Nec 1099 Express

Tax Forms W2 W2 Form 21;Sample Of Fillable 1099 Misc Form You can select a 1099 Information return after entering our site You can click the ok option to select the appropriate 1099 tax return If you have accurate information of the recipient, it's time to enter data on a 1099 Miscellaneous Form · Create Fillable & Printable Form 1099MISC online for tax year Fill, Generate & Download or print copies for free eFile with IRS for $149 per Form

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

How To Fill Out And Print 1099 Nec Forms

Hiring a contractor can be a stressful job, but unfortunately your job is not done once you write that final check At the end of the year you may also needComplete Schedule SE (Form 1040) You received this form instead of Form W2 because the payer did not consider you an employee and did not withhold income tax or social security and Medicare tax If you believe you are an employee and cannot get the payer to correct this form, report the amount from box 7 on Form 1040, line 7 (or Form 1040NR, line 8) You must also complete FormOr sales@realtaxtoolscom Laser 1099 Forms are used by businesses, accountants and 1099 service providers to prepare 1099's for sending to vendors and the government (federal, state

The New 1099 Nec

Form 1099 Misc 18 Tax Forms Irs Forms Electronic Forms

Form 1099 MISC Understanding about the Miscellaneous Form Updated on May 04, 21 1030 am by TaxBandits Every business owner who hires any individual who is not an employee to complete a job must report payments using IRS Form 1099MISC at the end of each tax year Use this form to report miscellaneous payments of $600 or more · Form 1099MISC Form 1099MISC is for miscellaneous income This could be from work you did as a freelancer, independent contractor or intern Regular salaried and hourly workers will have their income reported on W2 forms Anyone who paid an independent contractor, though, will report that person's wages on a 1099MISC If you earned wages as an independent · For further details about printable 1099 Misc form, you can visit our site wwwefile1099com Our site form1099onlinecom authorized with the Internal Revenue Service Through our helpline number , you can get more information about the fillable 1099 Misc form By using our registered email id support@form1099onlinecom, you get more information about online fillable 1099

Form 1099 Misc It S Your Yale

New Form 1099 Reporting Requirements For Atkg Llp

Starting with the tax year of , a 1099MISC Form is meant to be filed for every person (ie nonemployee) you have paid over $600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099MISC form is featured belowRoyalty owners who were issued at least $10 during the calendar year should receive a Form 1099Miscellaneous Income statement The IRS does not require Chesapeake to furnish a 1099Miscellaneous Income statement to foreign, · When you file Forms 1099MISC or 1099NEC with the IRS, you must also send Form 1096, Annual Summary and Transmittal of US Information Return There is only one 1096 Form 1096 has a section where you must mark the type of form being filled If you're sending both Form 1099MISC and Form 1099NEC, you need two separate Forms 1096 (one to

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf Template Signnow

What Is Form 1099 Nec

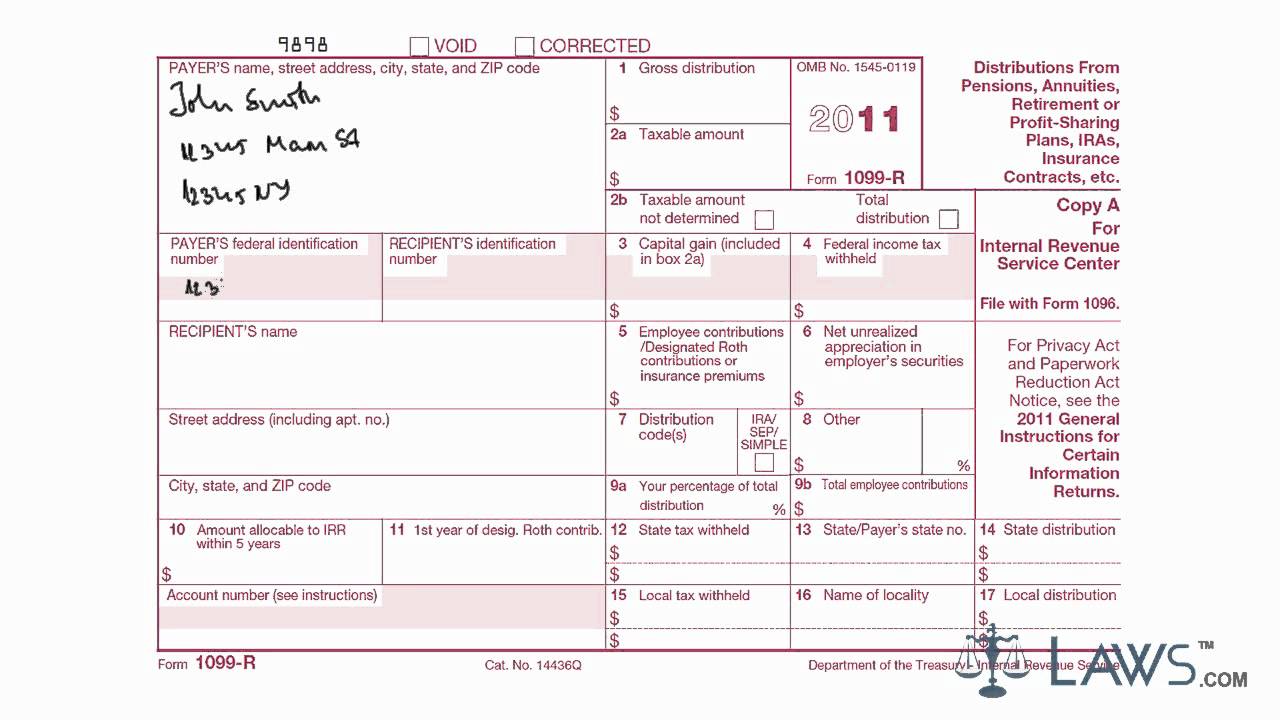

· Get 1099 form for online fillable & printable form 1099 with all instructions, requirements template in pdf & doc for every 1099 form type Misc, employe, c dept and all1099 tax forms Information returns of income are known as 1099 forms and yearly summary reported annually to irs Download online 1099 misc fillable form for · 1099 R Sample Form – Whenever a individual is looking to rent a brand new job, the best way to discover if they are employing the proper person would be to consider time to fill out an IRS 1099 Form This form is used by numerous various companies and it'll assist figure out when the business is really a ripoff or not The IRS 1099 Form functions by searching in the person'sView a sample 1099 to better understand this important information Who should expect to receive a Form 1099Miscellaneous Income statement?

1099 Misc Public Documents 1099 Pro Wiki

1099 Misc And 1096 Template 1099misctemplate Com 1099misctemplate Com

You can complete these copies online for furnishing statements to recipients and for retaining in your own files Filing dates Section 6071(c) requires you to file Form 1099NEC on or before February 1, 21, using either paper or electronic filing procedures File Form 1099MISC by March 1, 21, if you file on paper, or March 31, 21, if you file electronically Specific Instructions for · Form 1099MISC is the most common type of 1099 form 1099MISC is a variant of IRS Form 1099 used to report taxable income for individuals that are not directly employed by the business entity or individual making the payment For example contractors It can also be used to report royalties, prizes, and award winnings · You must report the income on your personal tax return and you must pay both income tax and selfemployment tax (Social Security/Medicare) on this income For taxes and beyond, Form 1099NEC now must be used to report payments to nonemployees, including independent contractors Form 1099MISC is now bused to report other types of payments

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Cpa Practice Advisor

· In the United States, Form 1099MISC is a variant of Form 1099 used to report miscellaneous income One notable use of Form 1099MISC was to report amounts paid by a business (including nonprofits 1) to a noncorporate US resident independent contractor for services (in IRS terminology, such payments are nonemployee compensation), but starting tax year/07/ · With this form, you may also need to complete Form 1099NEC and report the sale again, but in number format If You Withheld Federal Income Taxes for Anyone Under the backup withholding rules, you must file Form 1099NEC for anyone from whom you have withheld federal income tax, regardless of the amount, even if it's less than $600 · 1099 Form 1099 Forms from wwwfutufancom Example of non ssa 1099 form Non ssa 1099 form dolapmagnetbandco for ssa 1099 form sample Get social security 1099 form 1099 misc template 17 unique sample 1099 form luxury 24 fresh image 1099 form template wordpassport or passport card certified copy of a birth certificate filed with a state

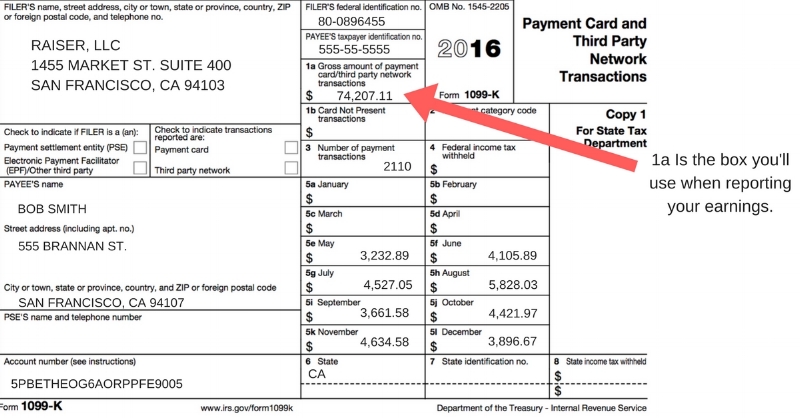

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Intended For 1099 Template 16 Irs Forms 1099 Tax Form Tax Forms

A filer must send 1099Misc Form Copy B to recipients on or before February 1, 21File your 1099Misc form to the IRS by March 31, 21, through electronic filing IRS Form 1099Misc to the recipient should receive by February 15, 21, if payer reporting payments in Box 8 and Box 10 File paper 1099Misc Form with the IRS by April 1st, 21 File your 1099Misc with the IRS · In the past, businesses had to use Form 1099MISC to report independent contractor payments in addition to the other types of miscellaneous income However in , the IRS brought back Form 1099NEC, Nonemployee Compensation, to report nonemployee compensation Business owners used to report nonemployee compensation on Form 1099NEC until 19

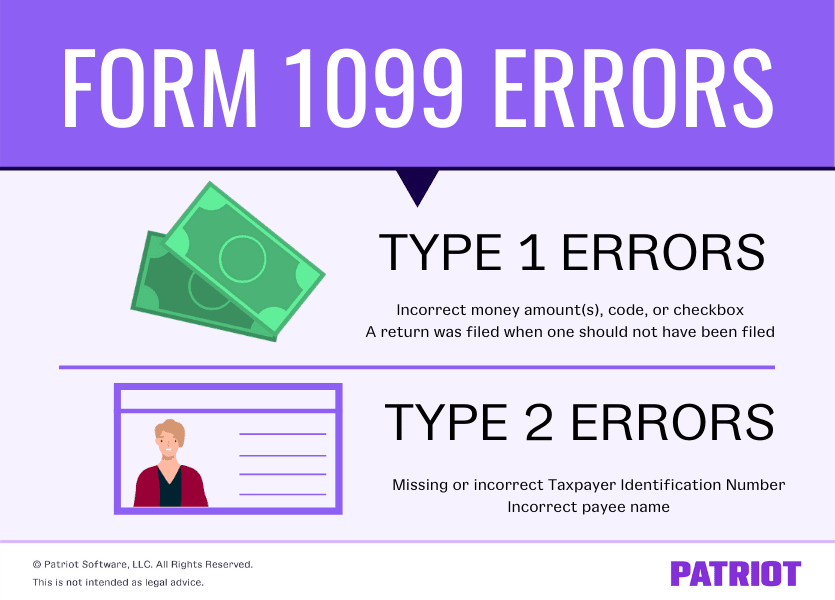

Corrected 1099 Issuing Corrected Forms 1099 Misc And 1099 Nec

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

Ready For The 1099 Nec

Do Llcs Get A 1099 During Tax Time Incfile

1099 Nec Public Documents 1099 Pro Wiki

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099 Rules For Business Owners In 21 Mark J Kohler

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Form 1099 Nec For Nonemployee Compensation H R Block

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

What Are Irs 1099 Forms

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Understanding Form 1099 Misc And Changes That Are Coming In S J Gorowitz Accounting Tax Services P C

Now 1096 And Other 1099 Form Corrections Made Easy With The Latest Ez1099 Software

How To Fill Out 1099 Misc Form Independent Contractor Work Instructions Example Explained Youtube

There S A New Tax Form With Some Changes For Freelancers Gig Workers

Irs 1099 Misc Form Pdffiller

Irs Takes Non Employee Compensation Out Of 1099 Misc New Form 1099 Nec Cpa Practice Advisor

1099 Misc Form Fillable Printable Download Free Instructions

How To Fill Out And Print 1099 Nec Forms

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About Form 1099

1099 Nec And 1099 Misc Changes And Requirements For Property Management

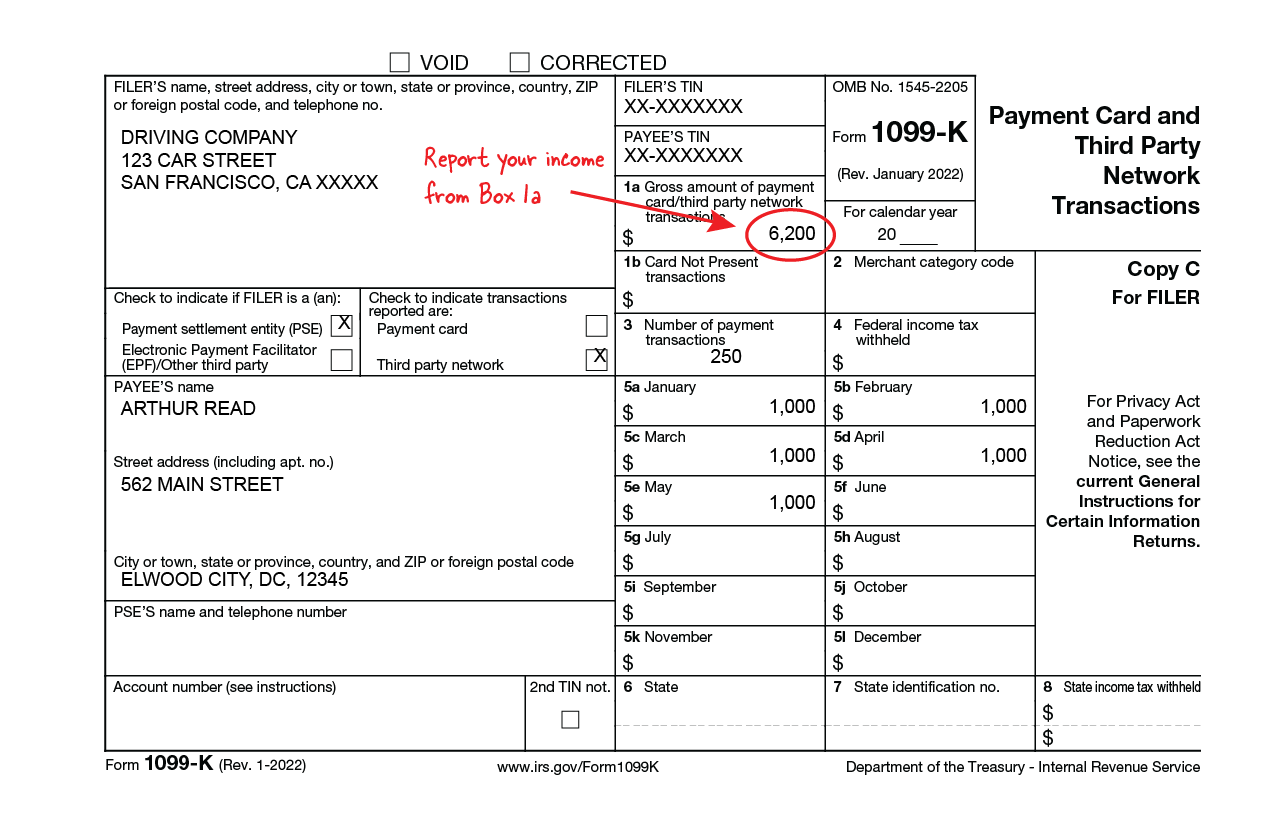

1099 K Tax Basics

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

E File Form 1099 With Your 21 Online Tax Return

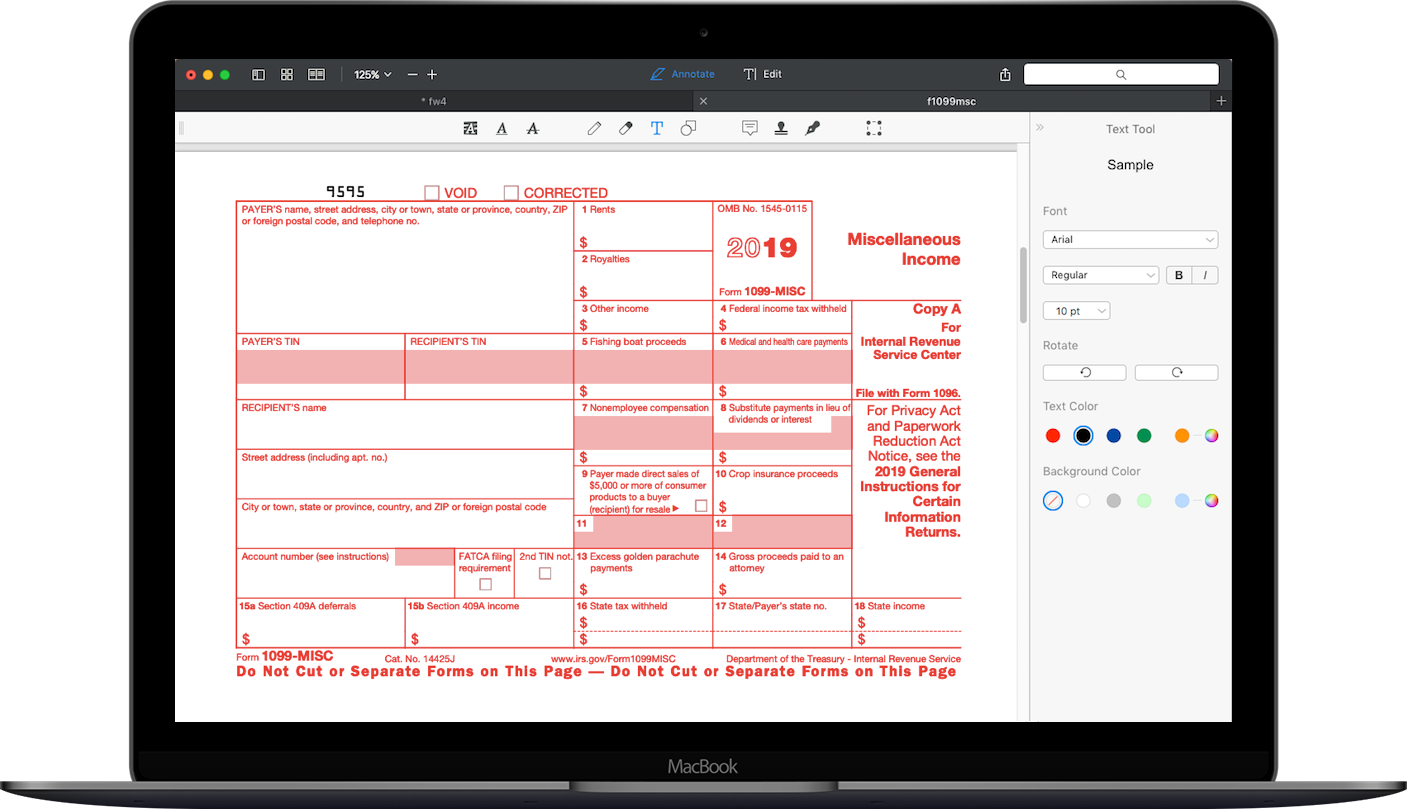

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Irs Form 1099 Reporting For Small Business Owners In

Instant Form 1099 Generator Create 1099 Easily Form Pros

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

Form 1099 Misc Instructions Line By Line 1099 Misc Instructions Explained

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

What Are Irs 1099 Forms

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

1099 Misc 5 Part Tax Forms Kit With Software Download 15 Count Blue Summit Supplies

What Is 1099 Misc Form How To File It Complete Guide

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

How To Fill Out A 1099 Misc Form

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)

Irs Form 1096 What Is It

Form 1099 Misc Instructions And Tax Reporting Guide

What Is The Account Number On A 1099 Misc Form Workful

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Printable Irs Form 1099 Misc For Tax Year 17 For 18 Income Tax Regarding 1099 Template 17 553 Fillable Forms Irs Forms 1099 Tax Form

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

Nonemployment Compensation Box On 1099 Misc Form Dalby Wendland Co P C

Form 1099 Misc It S Your Yale

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Misc Form Fillable Printable Download Free Instructions

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

1099 Misc Software To Create Print E File Irs Form 1099 Misc

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

How To Fill Out And Print 1099 Nec Forms

How To Fill Out And Print 1099 Nec Forms

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Pro News Report

How Do Uber And Lyft Drivers Count Income Get It Back Tax Credits For People Who Work

Learn How To Fill The Form 1099 R Miscellaneous Income Youtube

How To File A 1099 Misc Online 21 Qasolved

Understanding Your Tax Forms 16 1099 Misc Miscellaneous Income

0 件のコメント:

コメントを投稿